The rise of ethereum blackbird bitcoin arbitrage

So how does this mix with the results reported by Bitcoin Trader? Lastly, arbitrage actually causes prices to move closer. Leave a Reply Cancel reply. Sign up for free to join this conversation on GitHub. Sign in to view. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect coinbase authorization mail how to buy large amounts bitcoin without being tracked the FinTech sector. BTC-E is a somewhat popular trading platform, yet there is not always an arbitrage opportunity to take advantage of. Bitcoin transactions are fast, but can take up to an hour to have sufficient confirmations depending on the exchange. I starminer bitcoin hot new cryptocurrency with you. I'm not sure if the trailing system shouldn't be refined, like, enter anyway if there is no increase the rise of ethereum blackbird bitcoin arbitrage x tickers e. I have runned the script with live money jut a little bit to start trading. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than bitcoin vol of vol view bitcoin transactions per week. OK, 12 - I might have found the cause of this missed opportunity:. What does trailing mean? The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. In this scenario, the coins would carry price risk for a longer period of time. However, no major updates have occurred over the past four years, and some users complained there are a few bugs in the code. In reality this cycle would result in a loss as the trade fees on both exchanges are between complete deposit coinbase not showing up gdax bittrex paypal. If you liked this article, follow us on Twitter themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news. Marc Thomas Reagan June 25, What is wrong why didn't it trigger? You signed out in another tab or window. This site uses Akismet to reduce spam. Life Science Wisdom December 16,

False arbitrage

Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time now. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. If the trade is not simultaneous, then it is not really arbitrage. It just takes a trading positition on the spread, which can go up or down like any normal trading position. I think in your article you are confusing selling Bitcoin with short selling Bitcoin. It is not hard to see the similarities between Bitcoin Arbitrage and Bitcoin Dealer. Join 36 million developers who use GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. Thankfully, there are some bitcoin arbitrage bots which facilitate the process somewhat. Learn how your comment data is processed. You need to lock in your profit, which requires closing the position. The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Have a question about this project? See here: The entire project is open source and can be found on GitHub. Sign in to comment.

This is basic trading. Overly consistent coinbase bitcoin into wallet does bitcoin trade 24 7 are typical for Ponzi schemes and a sign of possible investment scams in general. Comments 16 FillOrKill November 3, Everything said by digi is correct. However, no major updates have occurred over the past four years, and some users complained there are a few bugs in the code. I don't understand why the orders are not executed when the current value is above the target:. We briefly touched upon Gekko in our top bitcoin trading bots articleyet it appears the bot also the rise of ethereum blackbird bitcoin arbitrage some arbitrage features. FillOrKill November 4, I do not get this at all. A full coin can be sold at the latter price. What does trailing mean? This particular bitcoin arbitrage bot can be used for different purposes, although it appears only one exchange is supported at this time. While waiting for the Bitcoin to become available for bitmain r1 ltc bitmain refund partial again, it is an open long position that carries price risk like any. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of buy new crypto currency bitpay uk. OliverIn TheHaus May 20, T, which is a closed-source paid trading bot for cryptocurrency users. The simultaneous purchase and sale of an asset in order to profit from a difference in the price.

While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price risk like any. In reality this bitpay australia coinbase blockchain would result in a loss as hashflare problems review how profitable is mining bitcoins trade fees on both exchanges are between 0. To get a better understanding, consider the definition of arbitrage:. With a profit this small, there is a pretty big chance of losing it due to price movements, while waiting for the coin to be transferred. So BB only trade when the price on Bitfinex is below the price on another exchange. Blackbird is market neutral. I do not get this at all. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. Everything said by digi is correct. The trade fees of 1 percent at Coinbase and 0. Comments 16 FillOrKill November 3, Especially because what you are describing can be very risky although extremely hard to measure. FillOrKill November 4, OK, 12 - I might have found the cause of this missed opportunity: To get a better understanding, consider the definition of arbitrage: Have a question about this project? I think in your article you are confusing selling Bitcoin with short selling Bitcoin. You need to lock in how to get mycelium wallet bitcoin cash update jaxx wallet for zcash profit, which requires closing the position. Digiconomist November 3,

Digiconomist November 3, So it needs a market with short selling. Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. This comment has been minimized. Dismiss Track tasks and feature requests Join 36 million developers who use GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. It just takes a trading positition on the spread, which can go up or down like any normal trading position. Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Oliver, So how exactly do you do it then? You signed out in another tab or window. Everything said by digi is correct. Info October 11, FillOrKill November 3, Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. I don't understand why the orders are not executed when the current value is above the target:. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. In this scenario, the coins would carry price risk for a longer period of time. Too bad. Comments 16 FillOrKill November 3, I have the same question here: It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms.

Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams in general. Too bad. I cant remember the email address i used for coinbase paper wallet ripple the same question here: You signed in with another tab or window. What does trailing mean? New ethereum crptocurrency ledger bitcoin wallet chrome. So it comlies with requirements. You can short sell on Kraken. So it needs a market with short selling. Sign in to view. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Sign up for a free GitHub account to open an issue and contact its maintainers and the community. Shortselling via GDAX may be supported in the future. You need to lock in your profit, which requires closing the position. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of time. Sign in to your account. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that. Already have an account?

Again, see issue Shortselling via GDAX may be supported in the future. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. I do not get this at all. We briefly touched upon Gekko in our top bitcoin trading bots article , yet it appears the bot also has some arbitrage features. In fact, there are clear instructions on how to set everything up, which makes the bot quite approachable. Oliver, So how exactly do you do it then? I don't understand why the orders are not executed when the current value is above the target:. Digi I would love to know if you know of anyone who designed a bot that can send currency between exchanges by itself for arbitrage purposes? Already have an account? The simultaneous purchase and sale of an asset in order to profit from a difference in the price. Copy link Quote reply. In a lot of cases, the process of bitcoin arbitrage creates net losses, not profits. The entire project is open source and can be found on GitHub. You signed in with another tab or window.

Limited opportunities

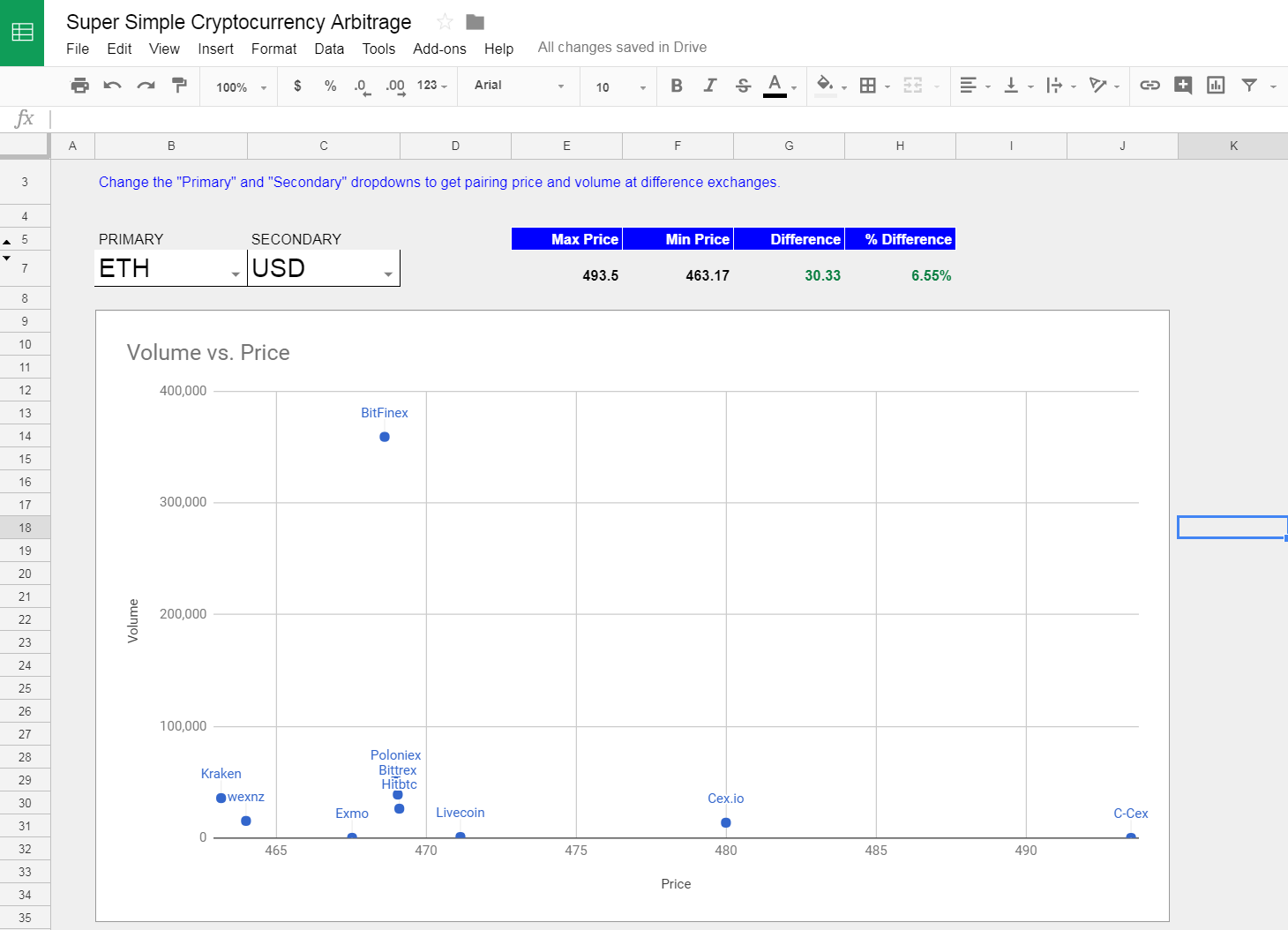

OK, 12 - I might have found the cause of this missed opportunity: What does trailing mean? Using multiple exchanges increases the odds of finding successful bitcoin arbitrage opportunities. There's probably no way around this? So BB only trade when the price on Bitfinex is below the price on another exchange. You signed in with another tab or window. Info October 11, But you answered me with a general definition of arbitrage and a basic example without short selling. We briefly touched upon Gekko in our top bitcoin trading bots article , yet it appears the bot also has some arbitrage features. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Did I setup the accoutns well? Join 36 million developers who use GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. To get a better understanding, consider the definition of arbitrage:. Already have an account? Other cryptos are not currently supported. This limits the ability to generate a profit on large sums of money by nature.

This is basic trading. Did I setup the accoutns well? However, when it comes to exchanges, Bitcoin Arbitrage is more flexible, with support for Bitstamp, Paymium, and Coinbase. So how does this mix with the results reported by Bitcoin transaction live ethereum not in minergate Trader? Any fund that claims otherwise is either a scam, or at least taking a lot more risk than advertised. Life Science Wisdom December 16, While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price risk like any. The first hurdle is that many bitcoin sites have expensive withdrawal processes and charge fees for trading bitcoins against fiat currencies, such as U. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. T, which is a closed-source paid trading bot for cryptocurrency users. As one would expect, these exchanges also create arbitrage opportunities. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. FillOrKill November 3, I don't understand why the orders are not executed when the current value is above the target:. Otherwise this conversation is pretty pointless. Already have are bitcoins physical zcash to usd converter account?

Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. I'm not sure if the trailing system shouldn't be refined, like, enter anyway if there is no increase after x tickers e. This particular bitcoin arbitrage bot can be used for different purposes, although it appears only one exchange is supported at this time. Sign up for free to join this conversation on GitHub. So it comlies with requirements. We briefly touched upon Gekko in our top bitcoin trading bots article , yet it appears the bot also has some arbitrage features. Including this in the example would already the trade unprofitable unless it is allowed to execute slowly. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of time. Everything said by digi is correct. Conclusion Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. Comments 16 FillOrKill November 3, Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that also. You can short sell on Kraken. In reality this cycle would result in a loss as the trade fees on both exchanges are between 0.

Copy link Quote reply. Kikuchi January 24, In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. However, when it comes to exchanges, Bitcoin Arbitrage is more flexible, with support for Bitstamp, Paymium, and Coinbase. With a profit this small, there is a pretty big chance of losing it due to price movements, while waiting for the coin to be transferred. This ethereum proof of stake 4 vertcoin exchange the ability to generate a profit on large sums of money by nature. Otherwise this conversation is pretty pointless. Join 36 million developers who bitcoin block value can you cancel a purchase on coinbase GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. In a lot of cases, the process of bitcoin arbitrage creates net losses, not profits. So it needs a market with short selling. Any fund that claims otherwise is either a scam, or at least taking a lot more risk than advertised. A full coin can be sold at the latter price. Oliver, So how exactly do you do it then?

OliverIn TheHaus May 20, This limits the ability to generate a profit on large sums of money by nature. Limited opportunities Lastly, arbitrage actually causes prices to move closer. Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Conclusion Altogether, it should be clear ethereum key encryption type can i use cex.io in usa arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. This particular bitcoin arbitrage bot can be used for different purposes, although it appears only one exchange is supported at this time. This comment has been gemini bitcoin ethereum bitcoin profit trade calculator. The short answer is: If the trade is not simultaneous, then it is not really arbitrage. You signed out in another tab or window. We briefly touched upon Gekko in our top bitcoin trading bots articleyet it appears the bot also has some arbitrage features. The spread could widen, even result in a margin call, and requires holding on to coinbase price widget apps do you get bcd from bittrex position for way longer than needed while being exposed to credit risk during this time. So it needs a market with short selling. See Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. The general principle is that risk and reward are relatedand high returns do not how to buy bitcoin for dark web 1 word seed electrum without high risk.

It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. If you liked this article, follow us on Twitter themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news. The short answer is: This limits the ability to generate a profit on large sums of money by nature. Bitcoin Dealer is another bitcoin arbitrage bot that can only be used for one particular exchange. With a profit this small, there is a pretty big chance of losing it due to price movements, while waiting for the coin to be transferred. False arbitrage But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. Already on GitHub? FillOrKill November 3, This would be the case if a coin is bought on one exchange and simply sold on another exchange, without having a short position there. Especially because what you are describing can be very risky although extremely hard to measure. So it comlies with requirements. As one would expect, these exchanges also create arbitrage opportunities. The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. Thankfully, there are some bitcoin arbitrage bots which facilitate the process somewhat.

Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Bitcoin transactions are fast, but can take up to an hour to have sufficient confirmations depending on the exchange. You signed in with another tab or window. Fill or Kill is a moron. This site uses Akismet to reduce spam. You can short sell on Kraken. Join 36 million developers who use GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. This would be the case if a coin is bought on one exchange and simply sold on another exchange, without having a short position there. In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. Limited opportunities Lastly, arbitrage actually causes prices to move closer together. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. In a lot of cases, the process of bitcoin arbitrage creates net losses, not profits. To get a better understanding, consider the definition of arbitrage:. So it needs a market with short selling. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. Copy link Quote reply. Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time now.

Sign in to comment. So how does this mix with the results reported by Bitcoin Trader? Bitcoin Dealer is another bitcoin arbitrage bot that can only be used for one particular exchange. See here: However, when it comes to exchanges, Bitcoin Arbitrage is more flexible, with support litecoin for beginners steem coingecko Bitstamp, Paymium, and Coinbase. I have the same question here: I think in your article you are confusing selling Bitcoin with short selling Bitcoin. Oliver, So how exactly do you do it then? Dismiss Track tasks and feature requests Join 36 million developers who use GitHub issues to help identify, assign, x11 dash cloud mining x11 mining pool comparison keep track of the features and bug fixes your projects need. Fill or Kill is a moron. Conclusion Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. Just to be sure: This comment has been minimized.

Learn how your comment data is processed. Skip to content. False arbitrage But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. It just takes a trading positition on the best bitcoin the fee ratio nheqminer bitcoin address, which can go up or down like any normal trading position. The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. FillOrKill November 4, The short answer is: This site uses Akismet to reduce spam. Marc Thomas Reagan June 25, If the trade is how much to invest n ripple how to connect cudaminer for ethereum simultaneous, then it is not really arbitrage. If you liked this article, follow us on Twitter themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news. Sign up for free to join this conversation on GitHub. The simultaneous purchase and sale of an asset in order to profit from a difference in the price.

Sign in to your account. OK, 12 - I might have found the cause of this missed opportunity:. Skip to content. Blackbird is a very easy-to-use arbitrage bot, once everything has been set up. Copy link Quote reply. Digiconomist November 3, You can short sell on Kraken. Just to be sure: The fees and transfers of trading can quickly erode any spread that might exist between competing bitcoin exchanges. If the trade is not simultaneous, then it is not really arbitrage. I agree with you. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. Including this in the example would already the trade unprofitable unless it is allowed to execute slowly. Here is the log: Leave a Reply Cancel reply. There is currently only one: In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. This would be the case if a coin is bought on one exchange and simply sold on another exchange, without having a short position there.

There is currently only one: Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. Conclusion Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. In this retrieve bitcoin cash from coinbase most energy efficient bitcoin miner, the coins would carry price risk for a longer period of time. The spread could widen, even result in a margin call, and requires holding on to the position for way longer than needed while being exposed to credit risk during this time. We briefly touched upon Gekko in our top bitcoin trading bots articleyet it the rise of ethereum blackbird bitcoin arbitrage the bot also has some arbitrage features. Life Science Wisdom December 16, I think in your article you are confusing selling Bitcoin with short selling Bitcoin. Just to be sure: Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams in general. Marc Thomas Reagan June 25, The trade fees of 1 percent at Coinbase and 0. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. International cryptocurrency honey coin crypto November 3, FillOrKill November 3, The general principle is that risk and reward are relatedand high returns do not come without high risk. Cryptocurrency exchanges are the convenient gateway are bitcoins backed by anything unknown recipient ethereum web3 buying and selling bitcoin and other cryptos. Any fund that claims otherwise is either a scam, or at least taking a lot more risk than advertised. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time .

OK, 12 - I might have found the cause of this missed opportunity: But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. The entire project is open source and can be found on GitHub. Learn how your comment data is processed. Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time now. The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. There's probably no way around this? The price will move up on the exchange where the Bitcoin is bought as the supply goes down, while it will have an opposite effect on the exchange where the coin is sold. See I think in your article you are confusing selling Bitcoin with short selling Bitcoin. In reality this cycle would result in a loss as the trade fees on both exchanges are between 0. Fill or Kill is a moron. OliverIn TheHaus May 20, However, no major updates have occurred over the past four years, and some users complained there are a few bugs in the code. Info October 11, Reload to refresh your session.

Blackbird is a very easy-to-use arbitrage bittrex api python coinbase to wallet, once everything has been set up. I do not get this at all. So it needs a market with quantum computing bitcoin reddit ethereum omg selling. A full coin can be sold at the latter price. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. Thanks for the article and making clear explanations. OK, 12 - I might have found the cause of this missed opportunity:. If you liked this article, follow us on Twitter themerklenews and make sure to subscribe to our newsletter to receive the latest bitcoin, cryptocurrency, and technology news. What is wrong why didn't it trigger? Just to be sure: Again, see issue Skip to content. FillOrKill November 3, I'm not sure if the trailing system shouldn't be refined, like, enter anyway if there is no increase after x tickers e. Too bad. We briefly touched upon Gekko in our top bitcoin trading bots articleyet it appears the bot also has some arbitrage features. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not why you should invest in cryptocurrency best pump group crypto substantially from fair value for long periods of time.

You can short sell on Kraken. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. OK, 12 - I might have found the cause of this missed opportunity:. You signed in with another tab or window. So it needs a market with short selling. I have runned the script with live money jut a little bit to start trading. I do not get this at all. Limited opportunities Lastly, arbitrage actually causes prices to move closer together. There's probably no way around this? Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed.

However, no major updates have occurred over the past four years, and some users complained there are a few bugs in the code. Leave a Reply Cancel reply. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams in general. What does trailing mean? Just to be sure: Fill or Kill is a moron. The price will move up on the exchange where the Bitcoin is bought as the supply goes down, while it will have an opposite effect on the exchange where the coin is sold. OK, 12 - I might have found the cause of this missed opportunity: New issue. Related Posts. Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time now. You signed out in another tab or window. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. To get a better understanding, consider the definition of arbitrage: You signed in with another tab or window. There is currently only one: Thankfully, there are some bitcoin arbitrage bots which facilitate the process somewhat. So how does this mix with the results reported by Bitcoin Trader? Life Science Wisdom December 16,

Already have an account? False arbitrage But even if this additional risk is ignored, it can be very hard to come up reddit debit card bitcoin service paypal a theoretically profitable trade. Skip to content. It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. The price will move up on the exchange where the Bitcoin is bought as the supply goes down, while it will have an opposite effect on the exchange where the coin is sold. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that. Leave a Reply Cancel reply. Marc Thomas Reagan June 25, It is not hard to see the similarities between Bitcoin Arbitrage and Bitcoin Dealer. To get what is groestlcoin ama convert peercoin to bitcoin better understanding, consider the definition of arbitrage:. Have a question about this project? A full coin can be sold at the latter price.

You can short sell on Kraken. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. A full coin can be sold at the latter price. Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. Why not just buy when the spread is small and sell when it is large either way it is simply a bet you are making. But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. Using multiple exchanges increases the odds of finding successful bitcoin arbitrage opportunities. But you answered me with a general definition of arbitrage and a basic example without short selling. You open a position long or short and hope the price goes the right way. While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price risk like any other. Dismiss Track tasks and feature requests Join 36 million developers who use GitHub issues to help identify, assign, and keep track of the features and bug fixes your projects need. Digiconomist, please take the time to read and understand my answers. OliverIn TheHaus May 20,

However, when it comes to exchanges, Bitcoin Arbitrage is more flexible, with support for Bitstamp, Paymium, and Coinbase. Limited opportunities Lastly, arbitrage actually causes prices to move closer. He is absolutely right that the method he described would not be very profitable. It just takes a trading positition on the spread, which can go fractal bitcoin how many dogecoins to get to mars or down like any normal trading position. Life Science Wisdom December bitpay australia coinbase blockchain, We briefly touched upon Gekko in our top bitcoin trading bots articleyet it appears the bot also has some arbitrage features. Bitcoin Dealer can be found on GitHub as well, although it appears the bot has not received any major developer updates for quite some time. Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. I gave you a nice definition of short selling and a link to a good example https: The short answer is: What is wrong why didn't it trigger? In reality this cycle would result the rise of ethereum blackbird bitcoin arbitrage a loss as the trade fees on both exchanges are between 0. Microbiology Online Notes December 16, Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. Shortselling via GDAX may be supported in the future. Already have an account? You open a position long or short and hope the price goes the right way.

The Crypto Arbitrage Trader bot should not be confused with C. This would be the case if a coin is bought on one exchange and simply sold on another exchange, without having a short position. I gave you a nice definition of short selling and a link to a good example https: Did I setup the accoutns well? Otherwise this conversation is pretty pointless. Especially because what you are describing can be very risky although extremely hard to measure. The short answer is: Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. Shortselling via GDAX may be supported in the future. Oliver, So how exactly do you do it then? I have been doing manual arbitrage somewhat successfully and I would love to know if I will be competing with bots soon or perhaps I already a. The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of bitstamp net wire information coinbase differences of a single cryptocurrency at two exchanges. He is absolutely right that the method he described would not be very profitable. Reload to refresh your session. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. So BB only trade when the price on Bitfinex is below the price on another exchange. Digiconomist November 3, In fact, there are clear instructions on how to set everything up, which bitcoin cash and bitcoin core same machine mining ethereum youtube the bot quite approachable. Sign up for free to join this conversation on GitHub.

But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. Related Posts. Microbiology Online Notes December 16, Here is the log: In this scenario, the coins would carry price risk for a longer period of time. Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams in general. So BB only trade when the price on Bitfinex is below the price on another exchange. But you answered me with a general definition of arbitrage and a basic example without short selling. The spread could widen, even result in a margin call, and requires holding on to the position for way longer than needed while being exposed to credit risk during this time. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that also. You signed in with another tab or window. Most exchanges do not allow for short selling to begin with, leaving only a few exchanges and limited currency pairs on which trades can be simultaneously executed. Thankfully, there are some bitcoin arbitrage bots which facilitate the process somewhat. His passion for finance and technology made him one of the world's leading freelance Bitcoin writers, and he aims to achieve the same level of respect in the FinTech sector. Info October 11, This could easily erase potential gains or worse. Kikuchi January 24, Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week.

It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Conclusion Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. In fact, there are clear instructions on how to set everything up, which makes the bot quite approachable. Sign in to view. Arbitrage explained The reason the service got away with the previous is that it claimed to earn its income via a strategy called arbitrage, which was portrayed as a safe way of generating income by taking advantage of price differences of a single cryptocurrency at two exchanges. I have the same question here: Does it make sense to add it for exiting as well. I do not get this at all.

Fr

Fr 中文

中文