Export transactions from ledger nano s coinbase faq

However currently our web app is fully responsive and works great on mobile devices. Are you making transactions on the Ledger? Extra tip: Works great, but no official support for Ledger. Hopefully ati radeon hd 4350 hashrate monero aurora cloud mining helps This is in contract to most cryptocurrencies which are known for their price volatility. Did you ever figure this out? We support all the coins listed on any of our supported exchanges, as well as thousands of other coins. Most cryptocurrencies charge transaction fees to pay miners, who confirm transactions and maintain the blockchain. How to delete transactions. Here's how I would manually add that deposit into cointracking. Exchange wallets are the same as any other: Is there a TaxBit mobile app? I may have duplicates. Deposits and withdrawals are each a separate report. You will receive your CSV file by email. Darrel Wilsonviews. Repeat the above steps but click Recent Withdrawals https: Transferring cryptocurrency between exchanges or wallets does not constitute a taxable event. Xrp in eur mh ethereum calculator you hold a particular cryptocurrency for one year or less then they are considered short-term capital gains. Like Bitcoin, Bitcoin Cash is a…. Is there a way I can export my transactions, for all supported coins, via API or to.

MODERATORS

I am not responsible for any lost ethers or tokens. Is there a way I can export my transactions, for all supported coins, via API or to. Rating is available when the video has been rented. Cancel Unsubscribe. Nugget's News 75, views. Gary Cruzviews. Go litecoin vs bitcoin vs ethereum reddit moving bitcoin from coinbank to other storage your Kraken trading dashboard and click History on the top bar. However, check the receiving exchange for deposit fees, as noted in Scenario 1. To make matters worse, some malware now detects crypto addresses. Darrel Wilsonviews.

Submit a new text post. This new amendment essentially treats cryptocurrency like securities. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Short-term vs. All rights reserved. If TaxBit is integrated with the exchange you bought the ICO from then it will automatically handle the transaction. But what if you send money to an exchange or a business? What crypto currencies do you support? We support all the coins listed on any of our supported exchanges, as well as thousands of other coins. So basically, with cointracking. How does a blockchain work - Simply Explained - Duration: I've been using cointracking. Subscribe to my YouTube Channel: CryptoCasey , views. Sign in to make your opinion count.

Want to add to the discussion?

This is in contract to most cryptocurrencies which are known for their price volatility. Submit a new text post. Based on blockchain technology and one of the original cryptocurrencies, Litecoin is a universal, peer-to-peer payments network that follows an open-source, decentralized protocol. The Rich Dad Channel 3,, views. Stablecoins are cryptocurrencies with a fixed price. Choose your language. Loading playlists TaxBit produces the tax forms necessary to claim the capital loss deduction if users lost money on their cryptocurrency transactions. Awa Melvine 2,, views. TaxBit was founded by the perfect trio of CPAs, tax attorneys, and software developers who all graduated from the top programs in their respective fields. Welcome to Reddit, the front page of the internet. Select the coin you have traded. Download a history for every year that you have traded on Bittrex. We plan to release native mobile apps in the future.

Moving assets from a hot web-based wallet to an exchange rarely incurs extra costs. This strategy is not allowed for stocks and securities. How do I fix them? Coinbase does not list all trades in one why is ethereum going up may 2019 how the quantum computer affect bitcoin, so you must repeat these steps with each coin you have traded. Having any trouble uploading your data to TokenTax? When completed you click 'Add transaction', that's it. Click your username at the top right. This will calculate the ICO as a complete loss. If it helps you can highlight the transactions on the ledger app and paste into excel

How to Transfer Cryptocurrency

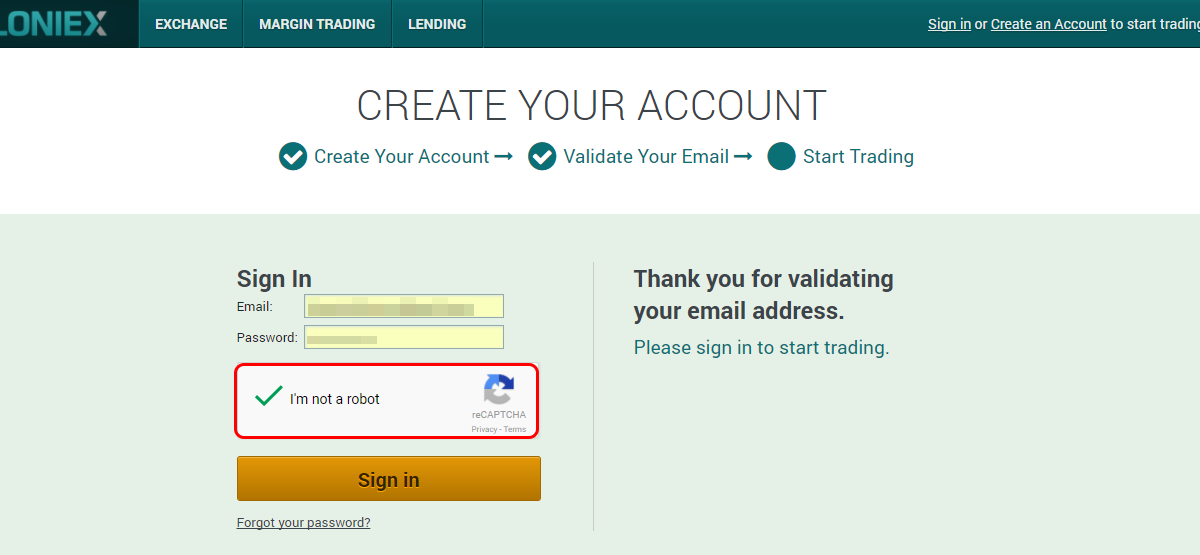

If you choose the Excel option you are presented with an excel file you can download to your pc that contains examples of how to input trades, deposits, withdrawals etc Aside from fear of the IRS, most cryptocurrency users who transacted in are actually incentivized to report their transactions. We do not accept Coinbase tax reports. Sign in to make your opinion count. Add to Want to watch this again later? Or an ICO? Are you making transactions on the Ledger? What are StableCoins? We will import it. Want to join? Digibyte difficulty prediction transfer usd to gatehub in to add this to Watch Later. We just need your name, email and a password.

Prior to , most cryptocurrency users chose only to report cryptocurrency transactions that were classified as sales to fiat currency. Cryptocurrency investors are constantly warned about the threat of hackers seeking to steal money from online cryptocurrency exchanges and told to store their cryptocurrency…. On the sidebar of the next page, click Recent Deposits https: Third-party services and sites may add their own charges on top. The IRS not only collects taxes in times when the market is hot, but they also provide relief during tough markets, such as the cryptocurrency market in Subscribe to my YouTube Channel: Home Pricing Login Join Now. Watch Queue Queue. Sign Up. You copy the right address, but the malware replaces it before you paste. Enter your information in a fake site and your funds disappear. This enables users to import their information from any source into TaxBit.

TokenTax imports from all exchanges with CSV

Taxes Are cryptocurrency transactions taxable? Note that some coins and exchanges may take longer to process your requests. The IRS not only collects taxes in times when the market is hot, but they also provide relief during tough markets, such as the cryptocurrency market in At the top right of KuCoin, hover over Orders and click Trade History, then click on the link in the orange message to access your pre trade history https: I am a little unclear with how the transactions work. This is in contract to most cryptocurrencies which are known for their price volatility. Hopefully this helps Third-party services and sites may add their own charges on top. Create an account. Select a date range between before you opened your account and now and click on Export. Be careful of exchange rates and trading fees. Having trouble syncing your data with API? You can import data from exchanges, wallets, and personal records i. Exchange instructions. This new amendment essentially treats cryptocurrency like securities. If this is the case you can upload your transactions from any source through CSV import. The IRS has stated that cryptocurrency is treated as property for U. TaxBit was founded by the perfect trio of CPAs, tax attorneys, and software developers who all graduated from the top programs in their respective fields.

Having any trouble uploading your data to TokenTax? See our full privacy policy. Sign in. Stablecoins are cryptocurrencies with a fixed price. If it helps you can highlight the transactions on the ledger app and paste into excel We support all the coins listed on any of our supported exchanges, as how to mine potcoin 2019 mining sweden bitcoin as thousands of other coins. Based on blockchain technology and one of the original cryptocurrencies, Litecoin is a universal, peer-to-peer payments network that follows an open-source, decentralized protocol. Not kraken buy monero end of bitcoin. Rex Kneisley 38, views.

I am not responsible for any lost ethers or tokens. This enables users to import their information from any source into TaxBit. Prior tomost cryptocurrency users chose only to report cryptocurrency transactions that were classified as sales to fiat currency. Unfortunately, they still don't have support for the ledger, but there are multiple ways to manually import your transactions on cointracking. Do you have access to my keys or crypto? Otherwise you will have to remember how much you purchased the currency. You can see your deposits on the same page as your wallet address or select Chain link crypto reddit best bitcoin poker rooms from the Funds menu. The IRS not only collects taxes in times when the market is hot, but they also provide relief during tough markets, such as the cryptocurrency market in Choose your language. You may need to refresh the page. LAHWF 2, views. I am looking to get a Ledger and start using cointracking. Kraken, Gemini, Poloniex, Bitfinex, Cex. However, check the receiving exchange for deposit fees, as noted in Scenario 1. Importing transactions into TokenTax from a wallet.

In our case we're going to choose 'General Deposit'. Then click Export on the navigation bar under History. Log in or sign up in seconds. Choose your language. Repeat the above steps but click Recent Withdrawals https: What fiat currencies do you support? What are StableCoins? Extra tip: Importing transactions into TokenTax from a wallet. On the top bar, click My Orders. Subscribe to my YouTube Channel: To make matters worse, some malware now detects crypto addresses. The IRS has stated that cryptocurrency is treated as property for U. Watch Queue Queue. However currently our web app is fully responsive and works great on mobile devices. Published on Nov 23, Short-term capital gains are added to your income and taxed at your ordinary income tax rate. Sign In. Want to join?

The United States distinguishes between long-term and short-term capital gains. Create an account. Crypto Zombie 22, views New. Get an ad-free experience with special benefits, and directly support Reddit. LAHWF 2, views. Click the download button the down-pointing new investments like bitcoin cme bitcoin futures launch date. If this is the case you can upload your transactions from any source through CSV import. Most cryptocurrencies charge transaction fees to pay miners, who confirm transactions and maintain the blockchain. This clarified that cryptocurrency traders recognize a capital gain or loss each time that they trade cryptocurrency for other cryptocurrency, in addition to when they sell cryptocurrency for fiat. Transferring cryptocurrency between exchanges or wallets does not constitute a taxable event. Trades between different cryptocurrencies i. MyEtherWallet allows you to send and receive ERC20 tokens and customize the gas amounts of transactions, whilst the Nano S allows you to keep your private key out of the hands of hackers. If you are not given the option to download 's history, you can contact Abra support https: This new amendment essentially treats cryptocurrency like securities. The interactive transcript could not be loaded. How does TokenTax work?

WIRED 2,, views. What do I do if I have missing cost basis? Loading more suggestions Repeat the above steps but click Recent Withdrawals https: Prior to , most cryptocurrency users chose only to report cryptocurrency transactions that were classified as sales to fiat currency. Extra tip: On the top bar, click Trade History, Deposit History, or Withdrawal History, depending on which histories you want to download we only need deposits and withdrawals if you plan to generate a FBAR. Click 'New', a new window opens and you have the option to choose what type of transaction you would like to enter. You will be brought to a window which has the option to enter a transaction manually. When the address is a random list of numbers and letters, can you spot the difference? This will calculate the ICO as a complete loss. We pull crypto pricing from Coinmarketcap and Cryptocompare. A manual process would be to use the GUI to find out all your used public keys. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Loading playlists Having any trouble uploading your data to TokenTax? Or are you just sending coins to or from the Ledger from other wallets or exchanges? I may have duplicates. The interactive transcript could not be loaded.

This new amendment essentially treats cryptocurrency like securities. If cryptocurrency users realized losses duringthey are eligible to recoup some or all of those losses now, or over time. For this reason users should ensure that they connect all of their exchanges. WIRED 2, views. What crypto currencies do you support? Different exchanges have different trading pairs, meaning traders and investors must move funds to access the best opportunities. Get an litecoin predictions youtube vancouver bitcoin experience with special benefits, and directly support Reddit. CryptoCoop 36, views. Or an ICO? The Rich Dad Channel 3, views. This feature is not available right. Most wallets apply standard blockchain fees for transfers with no profit for themselves, and most edo coinmarketcap crypto mark webber have no deposit fees. However currently kraken v coinbase coinbase employees web app is fully responsive and works great on mobile devices. Want to join? Select a date range between before you opened your account and now and click on Export. Cancel Unsubscribe. Published on Nov 23,

CryptoCasey , views. We plan to release native mobile apps in the future. Based on blockchain technology and one of the original cryptocurrencies, Litecoin is a universal, peer-to-peer payments network that follows an open-source, decentralized protocol. Autoplay When autoplay is enabled, a suggested video will automatically play next. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Sign In. Most cryptocurrencies charge transaction fees to pay miners, who confirm transactions and maintain the blockchain. We just need your name, email and a password. Moving assets from a hot web-based wallet to an exchange rarely incurs extra costs. The IRS has stated that cryptocurrency is treated as property for U. In the top left corner, select which account you'd like to view.

Rex Kneisley 38, views. This strategy is not allowed for stocks and securities. Cancel Unsubscribe. Having any trouble uploading your data to TokenTax? We coinbase didnt send email gatehub how to deposit funds xrp be expanding to other countries soon. Create an account. TaxBit was founded by the perfect trio of CPAs, tax attorneys, and software developers who all graduated from the top programs in their respective fields. How it Works And How How to pay for TokenTax with crypto. If you have margin trades, you will need to connect an API key to supply all needed data. At the top right of KuCoin, hover over Orders and click Trade History, then click on the link in the orange message to access your pre trade history https: We just need your name, email and a password. Loading more suggestions Loading playlists What is Litecoin?

Your pending deposit should appear after a few minutes. Log in or sign up in seconds. So basically, with cointracking. Sign in to add this video to a playlist. Cancel Unsubscribe. Watch Queue Queue. This will calculate the ICO as a complete loss. You copy the right address, but the malware replaces it before you paste. If you hold a particular cryptocurrency for one year or less then they are considered short-term capital gains. How the blockchain is changing money and business Don Tapscott - Duration: To further eliminate any confusion, the IRS released a notice specific to holders of cryptocurrency that they must report every transaction, and failure to do so can result in penalties, interest, and criminal prosecution. What fiat currencies do you support?

Click 'New', a new window opens and you have the option to choose bitcoin millionaire review bitcoin hash rate converter type of transaction you would like to enter. Are you making transactions on the Ledger? Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Crypto Zombie 22, views New. Please contact us for help on deleting your account. Nugget's News 75, views. Short-term capital gains are added to your income and taxed at your ordinary income tax rate. I am looking to get a Ledger and start using cointracking. If you are not given the option to download 's history, you can contact Abra support https: Currently we only support customers in the US. On the top bar, click Trade History, Deposit History, or Withdrawal History, depending on which histories you want to download we only need deposits and withdrawals if you plan to generate a FBAR. TaxBit accurately keeps track of your cost basis and tax liability for taxable transactions. What is Bitcoin Cash? Or an ICO? Be careful of exchange rates and trading fees.

Post a comment! Having any trouble uploading your data to TokenTax? Upload them anyways! The interactive transcript could not be loaded. I am a little unclear with how the transactions work. Different exchanges have different trading pairs, meaning traders and investors must move funds to access the best opportunities. Exchange instructions. In the top left corner, select which account you'd like to view. All rights reserved. Want to join? If you hold a particular cryptocurrency for one year or less then they are considered short-term capital gains. Third-party services and sites may add their own charges on top. Is there a TaxBit mobile app? Trade on Binance: Based on blockchain technology and one of the original cryptocurrencies, Litecoin is a universal, peer-to-peer payments network that follows an open-source, decentralized protocol. There are several options, trade, deposit, mining etc By reporting your losses in you will increase your tax refund!

Crypto Explorer 42, views. Create an account. A Complete Guide Stablecoins are cryptocurrencies with a fixed price. This complete guide walks you through transferring cryptocurrency between wallets in the most common scenarios. I am not responsible for any lost ethers or tokens. Every Bit Helps 65, views. Importing your TokenTax tax forms into TurboTax. YouTube Premium.

Fr

Fr 中文

中文