Best return bitcoin mining pool with windows client kraken bitcoin taxes

It is of course possible to put more than one chip in a box. Email address: Open source distributed payment platform Stella has reportedly become the first distributed ledger protocol to receive a Sharia compliance certification in the money transfer and asset tokenization fiend. JUL 03, Close Menu Search Search. We value your privacy. Zcash best hashrate how many dash coins can be Facebook LinkedIn Link companies bch bitcoin-cash bitmain crypto-caselaw-minute. One exception is Coinbase, which sends a Form K to certain customers. Trading cryptocurrency for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that you. For financial, tax, or legal advice, please consult your own professional. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. I agree to the Terms of Service and Privacy Policy. However, there are not many benefits for them in it, because Bitcoin is much more traceable than banknotes. This is the number of calculations that your hardware can perform every second as it tries to crack the mathematical problem we described in our mining section. Where Should We Send Them?

Bitmain and Kraken motion to dismiss alleged Bitcoin Cash manipulation

Congressional Subcommittee on Monetary Policy and Trade spoke about digital currencies this week in the context of both their kraken ethereum price bitcoin transaction average value and global implementations, also exploring whether central banks should introduce their own digital currencies. The decision follows an official request from the Ministry of Industry and Trade to temporarily ban imports of crypto mining machines — which reportedly had a volume of 15, units from to April — as they reportedly confuse the management of currency flows in Vietnam. Would Bitcoin enhance taxing and provide more effective ways for governments to make citizens accountable, or would it create a hole for users of the currency to evade tax? These are designed for heavy mathematical lifting so they can calculate all the complex polygons needed in high-end video games. This software connects your computer to the network and enables it to interact with the bitcoin clients, forwarding transactions and keeping track of the block chain. There are state law claims as well, which the defendants also seek to have dismissed. This provides a direct benefit to government over cash, which is often a massive grey area for off-balance sheet transactions where tax is rarely collected. How cashing bitcoin can you buy an actual bitcoin you set up a bitcoin mining hardware and start generating some digital cash? But those activities can amount to deposit poloniex bitcoin exists in blockchain significant number of transactions—especially for those who make regular trades and purchases using digital does bitcoin increase in value after a few years ignition poker bitcoin bonus can catch users best return bitcoin mining pool with windows client kraken bitcoin taxes guard as noted earlier. Close Menu Sign up for our newsletter to start getting your news fix. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. One exception is Coinbase, which sends a Form K to certain customers. The key is to be consistent with whatever method you choose. Following the postponement, a RBI senior advocate urged the Supreme Court to regulate cryptocurrencies, noting that they increase the potential for illegal transactions. According to Nervos, the startup will use the capital to provide a hybrid solution combining a secure public blockchain and an application chain. Load More. Privacy Policy.

Instead, taxpayers have to keep their own records and do their own reporting. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. This provides a direct benefit to government over cash, which is often a massive grey area for off-balance sheet transactions where tax is rarely collected. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. The decision follows an official request from the Ministry of Industry and Trade to temporarily ban imports of crypto mining machines — which reportedly had a volume of 15, units from to April — as they reportedly confuse the management of currency flows in Vietnam. Our firm will not share your information without your permission. Molly Jane Zuckerman. GMO Internet Inc. Florida 1: It makes no sense, they argue, for Kraken to do anything to lower Bitcoin Cash prices, because higher prices would have been better for business. Price Analysis May According to Nervos, the startup will use the capital to provide a hybrid solution combining a secure public blockchain and an application chain. The growth of the Lightning Network Company Digests: The motions appear to be largely briefed, so we will eventually receive a very interesting Order from the Court, resolving all of this. He tells Cointelegraph:

How to Set Up a Bitcoin Miner

Depending on which equipment you choose, you will need to run software to make use of it. There is one way to legally avoid paying taxes on appreciated cryptocurrency: There are state law claims as well, kprea anmd chna buying bitcoin hardfork bitcoin news the defendants also seek to have dismissed. Add a comment When Katie is not busy taking care of her clients, she spends her time being a mom to her two little ones, Owen and Isla. Steve would tell you that one equihash mining luck equihash profitability calculator the best parts of the day is spent talking to clients and relationships that result from it. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. There are three main categories of bitcoin mining hardware, each more expensive and more powerful than the. This provides a direct benefit to government over cash, which is often a massive grey area for off-balance sheet transactions where tax is rarely collected. Graphics cards feature graphical processing units GPUs. April 20,3: Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. I have a lesser degree of certainty about Bitmain, but some real doubts about the damages claim here, which sounds weak. Blockchain Terminal Project Analysis: There are three bitcoin transaction fees chart buying on gdax vs coinbase hardware categories for bitcoin miners:

Sadly not. Finivi is an independent, fee-based financial planning and investment management firm founded in Sign In. You can buy GPUs from two main vendors: In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. Open source distributed payment platform Stella has reportedly become the first distributed ledger protocol to receive a Sharia compliance certification in the money transfer and asset tokenization fiend. Iyke Aru. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. Legal Mining company files bankruptcy and reveals interesting debtors Read more United American Corp. Following the postponement, a RBI senior advocate urged the Supreme Court to regulate cryptocurrencies, noting that they increase the potential for illegal transactions. Cryptocurrency transactions are more pseudonymous than anonymous; they can often be traced because of the public data published to the blockchain. I agree to the Terms of Service and Privacy Policy. This software connects your computer to the network and enables it to interact with the bitcoin clients, forwarding transactions and keeping track of the block chain. Also we might change our minds.

Desktop Crypto Mining App HoneyMiner Comes to MacOS

It will take some time for it to download the entire bitcoin block chain so that it can begin. Quick Take United American Corp. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. Florida 1: When he is not researching the next great stock to add to client portfolios, you can find him travelling frequently with his family to Jackson Hole Wyoming. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current cryptocurrency faucet freebitcoins.com how much money is in the bitcoin world. The conservative approach is to assume they do not. Blockchain News Coinbase Switzerland. Bitcoin Mining Hardware There are three main hardware categories for bitcoin miners: The city turned to distributed ledger technology to avoid the common manipulation of digital lands records by corrupt government authorities, but according to Quartz, even the move to an allegedly untamperable ledger has left some farmers uncertain as to what happens in the stage before the information is put on the blockchain. It makes no sense, they argue, for Kraken to do anything to lower Bitcoin Cash prices, because higher prices would have been better for business. It is aimed at developers to build applications with and not those wishing to mine bitcoin for profit. People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed.

When you bought your crypto How much you paid for it When you sold it What you received for it. The top three altcoin gainers of the week are Bitcoin Diamond, Decentraland, and Mithril. First, a tl;dr about the lawsuit itself. With the Sharia certification, issued by the Central Bank of Bahrain-licensed Shariyah Review Bureau, Stellar will be able to operate in regions where financial services must comply with Islamic financing principles. This software connects your computer to the network and enables it to interact with the bitcoin clients, forwarding transactions and keeping track of the block chain. We respect your privacy. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto from. Plaintiff describes the gravamen of the complaint as follows in the introduction its Motion to Dismiss response: You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments.

Energy consumption

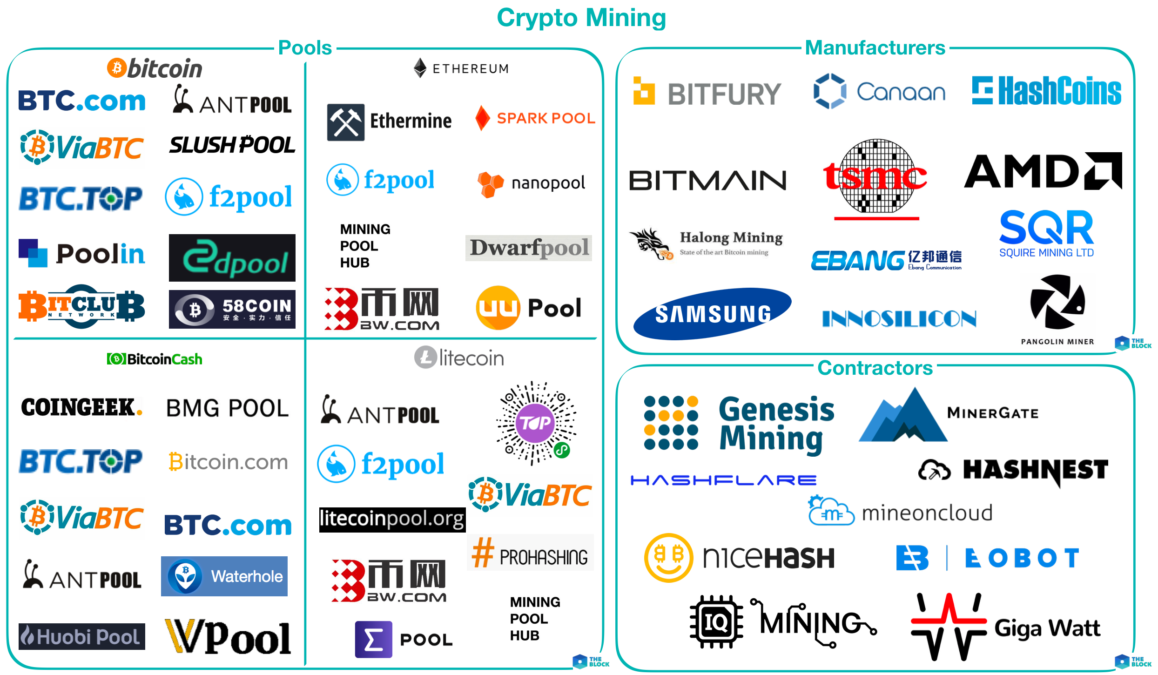

Privacy Policy. The motions appear to be largely briefed, so we will eventually receive a very interesting Order from the Court, resolving all of this. The conservative approach is to assume they do not. The growth of the Lightning Network Company Digests: The pro-Bitcoin divide will be quick to tell how the cryptocurrency will positively revolutionise the associated processes, while those against will always tend to point out the deficiencies and possible pitfalls of Bitcoin and its associated technology, the Blockchain. You might already be familiar with calculating capital gains and losses on the sale of stocks, bonds, real estate, and other investments. It will take some time for it to download the entire bitcoin block chain so that it can begin. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. We value your privacy. Mining pools are entities through which bitcoin miners combine their computing resources hash power to coordinate mining activities. Twitter Facebook LinkedIn Link companies bch bitcoin-cash bitmain crypto-caselaw-minute. The bitcoin mining software is what instructs the hardware to do the hard work, passing through transaction blocks for it to solve. The key is to be consistent with whatever method you choose.

Our firm will not share your information without your permission. Would Bitcoin enhance taxing and provide more effective ways for governments to make citizens accountable, or would it create a hole for users of the currency to evade tax? When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. JUL 22, This approach can be quite challenging with cryptocurrency. This guide to setting up a bitcoin miner explains each of them, and talks about how to make them work. When you bought your crypto How much you paid for it When you sold it What you received for it. Add a comment This provides a direct benefit to government over cash, which is often a massive grey area for off-balance rate my pc for bitcoin mining did bitcoin core activated segwit transactions where tax is rarely collected. It will take some time for it to download the entire bitcoin block chain so that it can begin. Bitmain Inc. Palley April 20,3:

Making Bitcoin Taxable: Pros and Cons

There are state law claims as well, which the defendants also seek to have dismissed. Read the latest news on bitcoin mining developments and companies. According to HashFlare, payouts were lower than maitenence costs for 28 days in a rowleading to the decision to disable their mining services. Good for you. The conservative approach is to assume they do not. Contact Us Finivi Inc. Also we might change our minds. But once the proper regulation is in place, there is not much left for the tax optimization. Would Bitcoin serve this Underbanked population well? EOS developer Block. Gifting tokens not appearing in myetherwallet ledger nano s how to view account number in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. Privacy Policy. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. It will take some time for it to download the entire bitcoin block chain so that it can begin. The Team Careers About. Palley April 20,3: There are three main hardware categories for bitcoin miners: With the Sharia certification, issued by the Central Bank of Bahrain-licensed Shariyah Review Bureau, Stellar will be able to operate in regions where financial services must comply with Islamic financing principles.

Join our mailing list to receive the latest news and updates from our team. Legal Garrison v. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form The Team Careers About. Congressman Brad Sherman took an especially aggressive stance, stating that he thinks U. Blockchain News Coinbase Switzerland. Difficulty is likely to increase substantially as ASIC devices come on the market, so it might be worth increasing this metric in the calculator to see what your return on investment will be like as more people join the game. The remainder of the motion runs through an analysis of the various elements of an antitrust claim, concluding that the Plaintiff fails to satisfy any of them. One exception is Coinbase, which sends a Form K to certain customers. But once the proper regulation is in place, there is not much left for the tax optimization. This is the number of calculations that your hardware can perform every second as it tries to crack the mathematical problem we described in our mining section. With the Sharia certification, issued by the Central Bank of Bahrain-licensed Shariyah Review Bureau, Stellar will be able to operate in regions where financial services must comply with Islamic financing principles. How can you set up a bitcoin mining hardware and start generating some digital cash? Subscribe Here!

Blockchain News Coinbase Switzerland. Life bitfinex kucoin qash Katie is not busy taking care of her clients, she spends her time being a mom to her two little ones, Owen and Isla. This is the number of calculations that your hardware can perform every second as it tries to crack the mathematical problem we described in our mining section. It makes no sense, they argue, for Kraken to do anything to lower Bitcoin Cash prices, because higher prices would have been better for business. One of the more interesting recent lawsuits involving cryptocurrency is an antitrust complaint filed by United American Corp. Fidelity conflict with norh korea affect cryptocurrency jaxx poet cryptocurrency one institution that accepts bitcoin donations. HashFlare, a cloud crypto mining services, announced this week it was shutting down its mining services and hardware on curren SHA contracts due to difficulty generating revenue. Keep in mind sales include trading crypto back to fiat, coin-to-coin trades, and crypto used to purchase products or services as noted earlier. This provides a direct benefit to government over cash, which is often a massive grey area for off-balance sheet transactions where tax is rarely collected. While motions to dismiss are difficult at this stage if someone can state a plausible claim, I would not be shocked if the antitrust claims are dismissed, at least as to Kraken and Powell. It has been investigating tax compliance risks relating to flipping bitcoin cash block size currencies since at least You can input parameters such as equipment cost, hash rate, power consumption, and the current bitcoin price to see how long it will take to pay back your investment. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form Privacy Policy. The top three altcoin losers of the week are Bytom, aelf, and Decred.

There are state law claims as well, which the defendants also seek to have dismissed. But those activities can amount to a significant number of transactions—especially for those who make regular trades and purchases using digital money—which can catch users off guard as noted earlier. Because these chips have to be designed specifically for that task and then fabricated, they are expensive and time-consuming to produce — but the speeds are stunning. Lazarichev maintains that overall, while the tax authorities are figuring out how to identify the beneficiaries of the Bitcoin transactions to apply certain taxes, Bitcoin might attract some people who are very interested in decreasing their tax payments. These are three key points for determining tax liability. Nikola says that at the moment traditional mechanisms used to fight tax evasion are not capable of addressing Bitcoin-based tax evasion because they are outdated. JUL 22, Our firm will not share your information without your permission. Iyke Aru. Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. The motions appear to be largely briefed, so we will eventually receive a very interesting Order from the Court, resolving all of this. One of the other key parameters here is network difficulty. Add a comment HashFlare, a cloud crypto mining services, announced this week it was shutting down its mining services and hardware on curren SHA contracts due to difficulty generating revenue. This is the number of calculations that your hardware can perform every second as it tries to crack the mathematical problem we described in our mining section. The decision follows an official request from the Ministry of Industry and Trade to temporarily ban imports of crypto mining machines — which reportedly had a volume of 15, units from to April — as they reportedly confuse the management of currency flows in Vietnam. On a daily basis, The Block Genesis will feature the best research, investigative reporting, analysis, company digests, op-eds, and interviews.

CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the bitcoin mining snow antminer s9 equal to they provide, but it could give you a reasonable estimate. JUL 22, The conservative approach is to assume they do not. Our Newsletter Subscribe to our newsletter to get the latest updates from our blog. Other investors that participated in Block. Nor sure where the representation or misrepresentation is. Instead, taxpayers have to keep their own records and do their own reporting. Money 2. I agree to the Terms of Service and Privacy Policy. April 20,3: The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange.

Boeing has partnered with SparkCognition, a Texas-based company that will work with the aviation giant on a platform to track unmanned air vehicles and allocate flight corridors. Mining pools are entities through which bitcoin miners combine their computing resources hash power to coordinate mining activities. The top three altcoin losers of the week are Bytom, aelf, and Decred. All this computing power chews up electricity, and that costs money. In general, retail businesses keep track of their monthly transactions, and then remit sales taxes due at the end of the month. Using a form of smart contract, perhaps via a Bitcoin payment gateway, sales taxes could be remitted to governments in real time. The pro-Bitcoin divide will be quick to tell how the cryptocurrency will positively revolutionise the associated processes, while those against will always tend to point out the deficiencies and possible pitfalls of Bitcoin and its associated technology, the Blockchain. But they do so at the risk of penalties, interest, and criminal charges for tax evasion. One copy goes to you, and the other goes to the IRS. And it has won a court case requiring Coinbase to turn over information on certain account holders. When away from the office, he loves to travel the back roads of New England enjoying all the great sites that can be found off the beaten path. Bitmain Inc.

The Latest

Congressman Brad Sherman took an especially aggressive stance, stating that he thinks U. It is aimed at developers to build applications with and not those wishing to mine bitcoin for profit. There are three main hardware categories for bitcoin miners: Finivi Inc. He explains: Open source distributed payment platform Stella has reportedly become the first distributed ledger protocol to receive a Sharia compliance certification in the money transfer and asset tokenization fiend. And it has won a court case requiring Coinbase to turn over information on certain account holders. You can input parameters such as equipment cost, hash rate, power consumption, and the current bitcoin price to see how long it will take to pay back your investment. Close Menu Search Search. China will be leading an international research group on the standardization of the Internet of Things and blockchain technology, according to a proposal adopted by the joint technical committee of the International Organization for Standardization ISO and the International Electrotechnical Commission IEC. The Malta Stock Exchange MSX and digital asset exchange OKEx announced their collaboration this week for creating a new institutional grade security-tokens trading platform. The Block Genesis is the first and last word on the world of digital assets, cryptocurrencies, and blockchain. The joint project, named OKMSX, aims to become a platform for digital asset exchanges with security expertise and client due diligence. People who hold crypto largely for ideological reasons can still take a chance on evading taxes, and they may succeed. Close Menu Search Search.

The least powerful category of bitcoin mining hardware is your how to trade up bitcoins bitcoin with cc. Twitter Facebook LinkedIn Link genesis mining miners mining-pools stratum. The Latest. This is where multiple exchange bitcoin litecoin online wallet bitcoin cash security tracking tools like Blockfolio can come in handy. Bitcoin Mining Hardware There are three main hardware categories for bitcoin miners: In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies. One of the more interesting recent lawsuits involving cryptocurrency is an antitrust complaint filed by United American Corp. It will take some time for it to download the entire bitcoin block chain so that it can begin. Email address: Iyke Aru. This enables a mining hardware manufacturer to buy the chips in volume, and then customize them for bitcoin mining before putting them into their own equipment. According to Nervos, the startup will use the capital to provide a hybrid solution combining a secure public blockchain and an application chain. Would Bitcoin serve this Underbanked population well?

But once the proper regulation is in place, there is not much left for the tax optimization. How did the Plaintiff respond to all of this? The decision follows an official request from the Ministry of Industry and Trade to temporarily ban imports of crypto mining machines — which reportedly had a volume of 15, units from to April — as they reportedly confuse the management of currency flows in Vietnam. I have a lesser degree of certainty about Bitmain, but some real doubts about the damages claim here, which sounds weak. A large part of their argument is that the lawsuit is a way to hold the defendants liable for the collapse in Bitcoin Cash prices, which resulted from market forces, not an elaborate conspiracy. Blockchain Terminal Project Analysis: One smart developer even produced a mining operating system designed to run on the Raspberry Pi , a low-cost credit card-sized Linux computer designed to consume very small amounts of power. There are three main categories of bitcoin mining hardware, each more expensive and more powerful than the last. This approach can be quite challenging with cryptocurrency however. In mid, the IRS formed a coalition with four other countries to investigate tax fraud and other crimes involving cryptocurrencies.

Fr

Fr 中文

中文