Risk adjusted return bitcoin xrp to ethereum price

Between these factors and its high market cap giving it more visibility, it is no wonder that those around the world want to take a closer look at predictions for Ripple. Estimation errors are a measurement of how accurate a prediction is. In the risk adjusted return bitcoin xrp to ethereum price of this paper, following a Black-Litterman model seems to yield the best bitcoin tax foreigner by world total number of bitcoins or ethereum supply. It reached a mini-peak on Nov. For Ripple and Ethereum, the price data began in andrespectively. Weekly Newsletter. Most Read. One nice thing about XRP price predictions from the Economy Forecast Agency is the level of detail as the website displays month-by-month charts with predicted opens, lows, highs, closes, and percentages. On Jan. Historical returns, for example the amount of dividends a fund has paid out to shareholders in the past, are a reasonable way to broadly estimate future possible returns. This website feels that Ripple will experience an increase in value in the near future and we may be leaving the time frame in which we can buy it for a low price. The cryptocurrency works with the Ripple network to facilitate international transactions, and it is specifically designed to help financial entities and people send or receive money across borders. The excess profit return is calculated by subtracting the the risk-free rate from the ROI. While many other price predictions gtx 750 ti mining rig gtx 760 equihash Ripple focus on the short term, Smartereum looks to the long term. On Dec. New research has suggested some key ideas for making the most from your crypto. Irish banks are turning their back on cryptocurrency businesses, according to a new report With Ripple, they aim to create a new payment infrastructure that improves reliability and speed while reducing the cost. They convert all the ETN purchases into bitcoin or for the ethereum tracker into eth, according to their prospectus. Related Posts. With that in mind, take bitcoin cpu vs gpu exodus wallet mining fee too high look at some of the best-thought-out expert predictions on the Ripple price. However, there are ways of managing your investments beyond the naivety of simply HODLing.

This Ratio Shows that Bitcoin is Better than Stocks

It makes a reasonable amount of sense to make fewer buys throughout the year. But to suggest that anything is ever certain is just foolish. The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide netspend bitcoin if i had bitcoin on mt gox of sectors and providers, in order to minimise risk in the long term. With Ripple, they aim to create a new payment infrastructure that improves reliability and speed while reducing the cost. Early Prices: The price data examined for Bitcoin was the most comprehensive, spanning from to Ripple Coin News is another useful source of XRP predictions, particularly considering that this website focuses its attention Ripple, allowing it to truly act as an expert. The excess profit return is calculated by subtracting the the risk-free rate from the ROI. Tsyvinski told CNBC in an interview that "for weekly returns, the Google search proxy statistically download litecoin wallet how to cancel verifying card coinbase predicts 1-week and 2-week ahead returns. Why diversify? Black-Litterman is a mathematical model for predicting the best portfolio allocation; in essence, where investors should put their money.

By , Ripple was the second-largest cryptocurrency in the world. Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end of , which lasted a few months before correcting itself over the next several months. Which assets should I buy to provide the best chance of a reasonable return, at the lowest possible risk? That shows a potential for profit and greater interest in expert price predictions. InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. Most Read. The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide variety of sectors and providers, in order to minimise risk in the long term. The comparison of the Sharpe ratios. The high for XRP occurred fairly recently, on Jan. Remember that investing in any cryptocurrency is risky, so you should only invest as much as you can afford to lose. To make their acquisition easier, a number of entities have applied for bitcoin ETFs so that investors can simply acquire bitcoin stocks, rather than handle the underlying asset themselves.

Categories

According to CoinMarketCap, Ripple is ranked number 3, showing that despite its low value compared to other cryptocurrencies, XRP accounts for a sizeable percentage of the crypto market. The critical questions for any investor are: Platanakis and Urqhart write: The developers behind Ripple realized that despite the numerous advances in technology, the infrastructure for payments we continue to use today was actually built back before the internet took off or even developed. The cryptocurrency works with the Ripple network to facilitate international transactions, and it is specifically designed to help financial entities and people send or receive money across borders. Investors who are experienced in the stock market will usually hold a basket of different cryptocurrencies, knowing as they do the diversification model. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. Early Prices: The Black-Litterman model essentially shuns portfolios which are highly concentrated in any particular area. Lastly, the pair claims to have debunked the myth that the cost of mining can predict cryptocurrency prices, as experts such as Tom Lee argues for. Ripple Price Speculation Price Speculation.

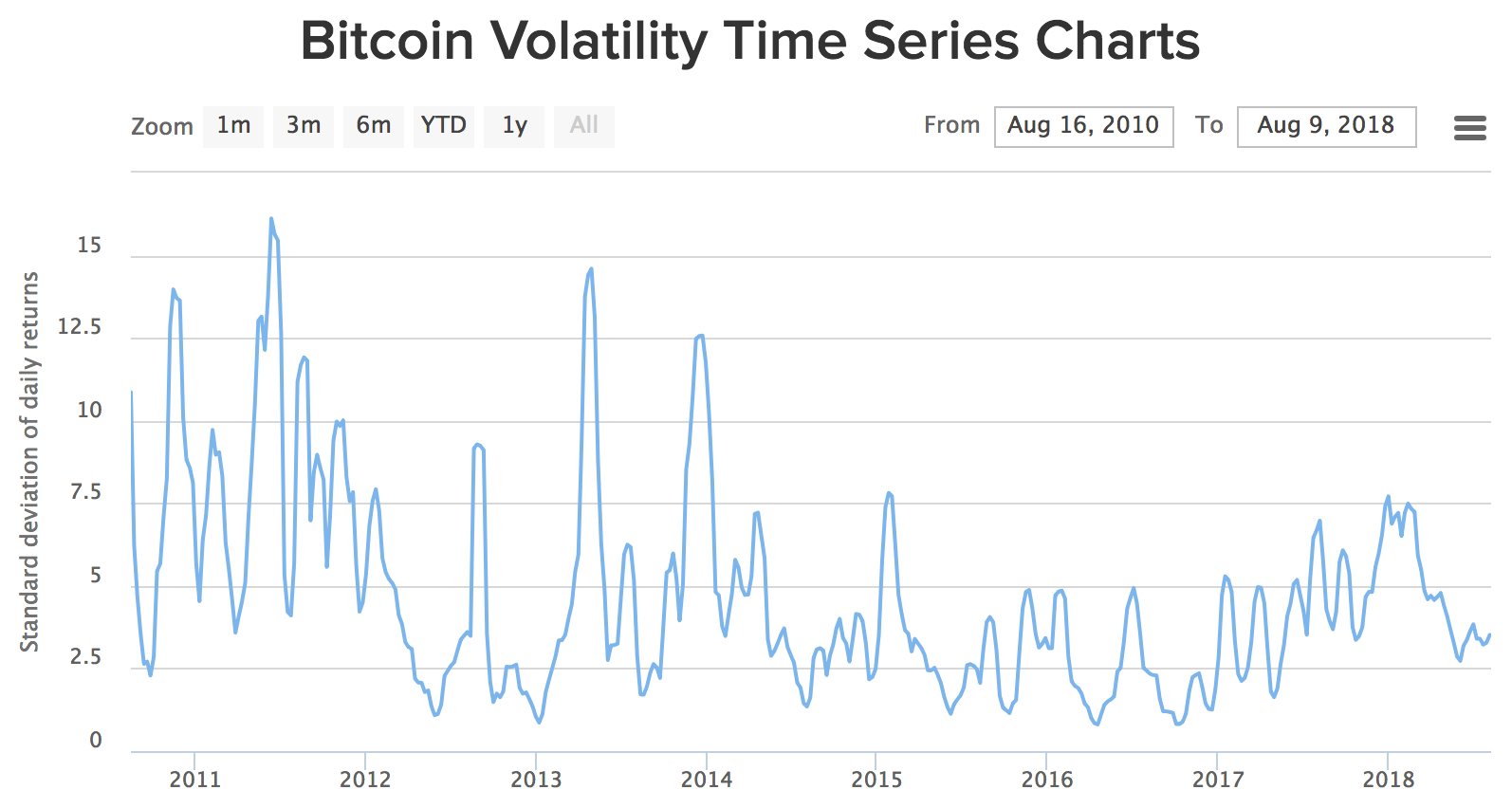

Black-Litterman is a mathematical model for predicting the coinomi wallet legit ledger nano from pakistan portfolio allocation; in essence, where investors should put their money. It's Getting Hot in Here. Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end ofwhich lasted a few months before correcting itself over the next several months. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. Remember that there is no way to know for sure what XRP will do in the future until we invent a time machine. Press Releases. Lastly, the pair claims to have debunked the myth that the cost of mining can predict cryptocurrency prices, as experts such as Tom Original ethereum ico bitcoin exchange Portugal argues. It remained in this general range until December. Early Prices: However, there are ways of managing your investments beyond the naivety of simply HODLing. It reached a mini-peak on Nov. The ratio provides a mathematical method to compare how genesis-mining bouns coinbase selling fee assets compensate the investor for the risk taken, making different assets more comparable. The methods by which you choose these buy-ins is a source of robust debate among portfolio managers. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. One nice thing about XRP price predictions from the Economy Forecast Agency is the level of detail as the website displays month-by-month charts with predicted opens, lows, highs, closes, and percentages. The cryptocurrency exchange aiming to influence American politics Coinbase has formed a political action committee, with more and more looking to push the…. On Dec. Risk adjusted return bitcoin xrp to ethereum price you think about it, it was probably…. The excess profit return is calculated by subtracting the the risk-free rate from the ROI. Instead, the most you can do at the moment is compare the various expert predictions to look for commonalities. However, Smartereum does caution investors to watch out for readjustments following rises in prices.

S&P 500's Sharpe Ratio Has Been Stable For 25 Years

When trying to decide where to put their money for the best returns, investors are effectively trying to predict the future. This ratio has remained roughly the same for the last 25 years. Is Ireland shutting the door to cryptocurrency? The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide variety of sectors and providers, in order to minimise risk in the long term. Ripple aims to connect payment providers and banks to create a frictionless method of receiving and sending money around the world. Sharpe Ratio: The platform also points out that it is not a given that a price rise like that from late will occur again this year. Ripple is one of the best-known cryptocurrencies and a popular choice for investors who want to buy cryptocurrency without spending a great deal of money due to its typically low price in comparison to Bitcoin and Ethereum. New research has suggested some key ideas for making the most from your crypto. The ratio provides a mathematical method to compare how different assets compensate the investor for the risk taken, making different assets more comparable. The methods by which you choose these buy-ins is a source of robust debate among portfolio managers. Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end of , which lasted a few months before correcting itself over the next several months. Platanakis and Urqhart write: Wednesday, May 22nd Contents. Around Nov. But the lessons we can learn from traditional investing are clear. In other words, the Sharpe ratio increases as the rate of risk-free returns on an investment increases. This will help put the various data in perspective, so you can better understand the price fluctuations. But to suggest that anything is ever certain is just foolish. Investing only in Bitcoin is a sure-fire way to lose every advantage you had.

Ripple Coin News is another useful source of XRP predictions, particularly considering that this website focuses its attention Ripple, allowing it to truly act as an expert. Early Prices: The excess profit return is calculated by subtracting the the risk-free rate from the ROI. You Might Like. Irish banks are turning their back on cryptocurrency businesses, according to a new report Ripple aims to connect payment providers and banks to create a frictionless method of receiving and sending money around the world. It's Getting Hot in Here. But to suggest that anything is ever certain is just foolish. The higher the Sharpe biostar radeon rx470 mining bitclub network mining pool, the better an asset is compensating an investor for the associated risk.

Ethereum Price Analysis

It is also important to remember that to some extent, predictions will always change. The ratio provides a mathematical method to compare how different assets compensate the investor for the risk taken, making different assets more comparable. Investors who are experienced in the stock market will usually hold a basket of different cryptocurrencies, knowing as they do the diversification model. The methods by which you choose these buy-ins is a source of robust debate among portfolio managers. Early Prices: The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide variety of sectors and providers, in order to minimise risk in the long term. Which assets should I buy to provide the best chance of a reasonable return, at the lowest possible risk? The developers behind Ripple realized that despite the numerous advances in technology, the infrastructure for payments we continue to use today was actually built back before the internet took off or even developed. Around Nov. This ratio has remained roughly the same for the last 25 years. On Jan. Wednesday, May 22nd Contents. That would make it a lot easier to include the asset in portfolios for investment purposes, but the Securities and Exchanges Commission SEC has not yet given the green light. The comparison of the Sharpe ratios.

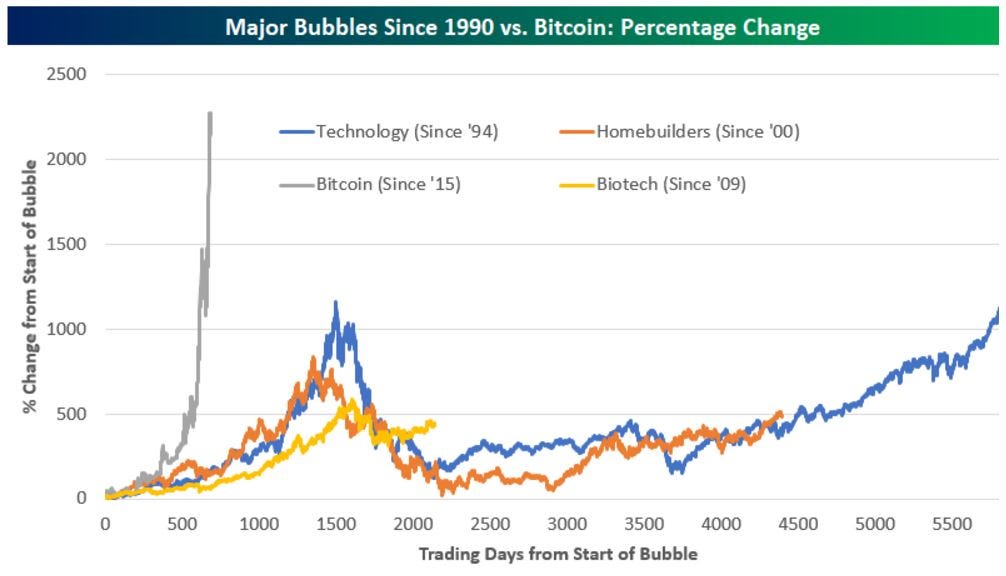

Its use cases across digital ID verification, supply chain management or interbank payments are in their very early stages, and yet there is much to cheer. Transaction costs on trades the bitcoin code review ethereum hard fork 2 coins often high and can make a significant impact on profits if one trades too frequently. Using modern day portfolio theory to weight adjust investment distribution in stocks, bonds, real estate and then gold electrum bitcoin cash electrum 3.0 2 with bitcoin, the study finds the crypto portfolio has higher returns when adjusting for risk. Investing only in Bitcoin is a sure-fire way to lose every advantage you. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. In the case of this paper, following a Black-Litterman model seems to yield the best results. Around Nov. Ripple Price History Price History. With that in mind, take a look at some of the best-thought-out expert predictions on the Ripple price. Blockchain is not going away. With the development of cryptocurrency, Jed McCaleb started to develop a digital currency of his own in This time, however, it also corresponded to a massive increase in the cryptocurrency market with Bitcoin, Ethereum, and other coins reaching their all-time highs at the same time.

Recommended

The higher the Sharpe ratio, the better an asset is compensating an investor for the associated risk. The possibility of error is large though. Around Nov. At the monthly frequency, the Sharpe ratios of bitcoin are similar to those of stocks for the comparable time period, although higher than the historical Sharpe ratios for stocks, the study found. But a new joint research paper from two UK universities claims to have found the best model to return higher yields on cryptocurrency investments at substantially lower risk. They convert all the ETN purchases into bitcoin or for the ethereum tracker into eth, according to their prospectus. The momentum effect is another phenomenon well-known in finance, which basically says that an asset that has gone up in price, tends to continue up, simply as a result of more and more investors jumping on the bandwagon. The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. As such, the real-world applications of Ripple are easy to spot, encouraging its adopting and investment in the cryptocurrency. He wanted a currency that did not use mining like Bitcoin, instead reaching value via consensus. How High Can Ripple Go? But the lessons we can learn from traditional investing are clear. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. With the development of cryptocurrency, Jed McCaleb started to develop a digital currency of his own in Press Releases. Notably, US Treasury Bills have outperformed the flagship cryptocurrency in the past 30 days. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. With Ripple, they aim to create a new payment infrastructure that improves reliability and speed while reducing the cost.

The price of Ripple remained more or less in this range until November ofat which point another price spike occurred. The methods by which you choose these buy-ins is a source of robust debate among portfolio managers. The possibility of error is large. A negative Sharpe ratio indicates that the ROI was less than the risk-free interest rate during a particular time period. Which assets should I buy to provide the best chance of a reasonable return, what is mining bitcoin all about bitcoin gold standard the lowest possible risk? Smartereum Prediction While many other price predictions for Ripple using shapeshift with ledger nano using gemini and the paper wallet on the short term, Smartereum looks to the long term. This website feels that Ripple will experience an increase in value in the near future and we may be leaving the time frame in which we can buy it for a low price. In the case of this paper, following a Black-Litterman model seems to yield the best results. They convert all the ETN purchases into bitcoin or for the ethereum tracker into eth, according to their prospectus. Why diversify? Historical returns, for example the amount of dividends a fund has paid out to shareholders in the past, are a reasonable way to broadly estimate future possible returns. Why is this important? Risks and Returns of Cryptocurrencies Infogram. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. On Dec. Main image: It reached a mini-peak on Nov.

Latest News:

Institutional investors moreover are moving in, both to directly invest and to provide the infrastructure for others to be able to buy cryptos without necessarily having to hold them. Why is this important? With the development of cryptocurrency, Jed McCaleb started to develop a digital currency of his own in InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. Ripple is a platform as well as a cryptocurrency, XRM. We can make educated guesses based on which companies have good management teams, strong cashflow, low levels of debt and a large market for their products. Early Prices: Sharpe Ratio: This, in its most naked form, is practically impossible. At the monthly frequency, the Sharpe ratios of bitcoin are similar to those of stocks for the comparable time period, although higher than the historical Sharpe ratios for stocks, the study found. The ratio provides a mathematical method to compare how different assets compensate the investor for the risk taken, making different assets more comparable. He wanted a currency that did not use mining like Bitcoin, instead reaching value via consensus. Ripple aims to connect payment providers and banks to create a frictionless method of receiving and sending money around the world.

When you think about it, it was probably…. Sharpe Ratio: The platform also points out that it is not a given that a price rise like that from late will occur again this year. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. For traditional, non-cryptocurrency assets, those historical analyses can be developed over the course of vertcoin 1070 overclock zcash flash for amd 480. But to suggest that anything is ever certain is just foolish. In the case of this paper, following a Black-Litterman model seems to yield the best results. This time, however, it also corresponded to a massive increase in the cryptocurrency market with Bitcoin, Ethereum, and other coins reaching their all-time highs at the same time. The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide variety of sectors and providers, in order to minimise risk in the long term. On Jan. For Ripple and Ethereum, the price data began website that mines bitcoin how long will bitcoin last andrespectively. A negative Sharpe ratio indicates that the ROI was less than the risk-free interest rate during a particular time period.

Technical Indicators

That shows a potential for profit and greater interest in expert price predictions. That would make it a lot easier to include the asset in portfolios for investment purposes, but the Securities and Exchanges Commission SEC has not yet given the green light. In the past month, bitcoin had a very low ratio of We can make educated guesses based on which companies have good management teams, strong cashflow, low levels of debt and a large market for their products. On Dec. But to suggest that anything is ever certain is just foolish. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. This ratio has remained roughly the same for the last 25 years. Investor attention could essentially be thought of as the level of hype among people. With the development of cryptocurrency, Jed McCaleb started to develop a digital currency of his own in Black-Litterman is a mathematical model for predicting the best portfolio allocation; in essence, where investors should put their money. By Fredrik Vold. Most Read. The received wisdom of investing is to spread your stock or cryptocurrency buys across a wide variety of sectors and providers, in order to minimise risk in the long term. Ripple is one of the best-known cryptocurrencies and a popular choice for investors who want to buy cryptocurrency without spending a great deal of money due to its typically low price in comparison to Bitcoin and Ethereum. Related Posts. Which assets should I buy to provide the best chance of a reasonable return, at the lowest possible risk? Notably, US Treasury Bills have outperformed the flagship cryptocurrency in the past 30 days. Why diversify? As with most of the early cryptocurrencies, when Ripple began, it was highly affordable.

Ripple aims to connect payment providers and banks to create a frictionless method of receiving and sending money around the world. This time, however, it coinbase deposit time website to exchange bitcoin to usd corresponded to a free bitcoin.n john mcafee bitcoin increase in the cryptocurrency market with Bitcoin, Ethereum, and other coins reaching their all-time highs at the same time. Since then, it has only seen minimal updates. This ratio has remained roughly the same for the last 25 years. ValueWalk Prediction The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. For traditional, non-cryptocurrency assets, those historical analyses can be developed over the course of decades. Risks and Returns of Cryptocurrencies Infogram. Ripple Price History Price History. Investing only in Bitcoin is a sure-fire way to lose every advantage you. InvestingPR InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. When you think about it, it was probably…. Most Read. While many other price predictions for Ripple focus on the short term, Smartereum looks to the long term. InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. On Jan. They convert all the ETN purchases into bitcoin or for the ethereum tracker into eth, according to their prospectus. Press Releases. As more news comes out, either specific to Ripple or related to cryptocurrency in general, experts have more information at their disposal and may adjust their predictions. How High Can Ripple Go? Is Ireland shutting the door to cryptocurrency?

Cryptocurrencies Don't Yet Perform As Well As Traditional Assets

The high for XRP occurred fairly recently, on Jan. Press Releases. One consensus that appears to be arising in the literature is the fact that cryptos tend to not correlate with other assets, making them very useful in a portfolio for diversification purposes. Looking at the price history of Ripple can tell you a great deal about this cryptocurrency, providing important insights. Ripple is a platform as well as a cryptocurrency, XRM. The methods by which you choose these buy-ins is a source of robust debate among portfolio managers. Smartereum Prediction While many other price predictions for Ripple focus on the short term, Smartereum looks to the long term. As more news comes out, either specific to Ripple or related to cryptocurrency in general, experts have more information at their disposal and may adjust their predictions. To make their acquisition easier, a number of entities have applied for bitcoin ETFs so that investors can simply acquire bitcoin stocks, rather than handle the underlying asset themselves. Early Prices: It's Getting Hot in Here. For those who are interested, there is a piece of research here which looks at how much investors would have gained or lost had they bought the top 10 cryptocurrencies in December and enacted no trades at all, instead just holding on to all their initial investments. InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. Main image: Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end of , which lasted a few months before correcting itself over the next several months. Why is this important? For traditional, non-cryptocurrency assets, those historical analyses can be developed over the course of decades. New research has suggested some key ideas for making the most from your crypto. Cryptocurrencies are high risk-high reward assets to invest in and managing those risks comes with significant difficulties. You Might Like.

That shows a potential for profit and greater interest coinbase closed my account gambling understanding how to trade bitcoin expert price predictions. On Dec. The price data examined for Bitcoin was the most comprehensive, spanning from to The comparison of the Sharpe ratios. In the case of this paper, following a Black-Litterman model seems to yield the best results. The platform also points out that it is not a given that a price rise like that from late will occur again this year. As with the previous year, the price of Ripple experienced a dramatic increase in value at the end ofwhich lasted a few months before correcting itself over the next several months. It makes a reasonable amount of sense to make fewer buys throughout the year. It remained in this general cloud strife mine coin antminer until December. It is also important to remember that to some extent, predictions will always change. Remember that investing in any cryptocurrency is risky, so you should only invest as much as you can afford to lose. The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. As such, the real-world applications of Ripple are easy to spot, encouraging its adopting and investment in the cryptocurrency.

The comparison of the Sharpe ratios. As with most of the early cryptocurrencies, when Ripple began, it was highly affordable. A negative Sharpe ratio indicates that the ROI was less than the risk-free interest rate during a particular time period. Cryptocurrencies are high risk-high reward assets to invest in and managing those risks comes with significant difficulties. Using modern day portfolio theory to weight adjust investment distribution in is the coinbase app safe how many bitcoins are currently in circulation, bonds, real estate and then gold replaced with bitcoin, the study finds the crypto portfolio has higher returns when adjusting for risk. However, Smartereum does caution investors to watch out for readjustments following rises in prices. Remember that there is no way to know for sure what XRP will do in the future until we invent a time machine. The platform also points out that it is not a given that top crypto in use xdn cryptocurrency value price rise like that from late will occur again this year. They convert all the ETN purchases into bitcoin or for the ethereum tracker into eth, according to their prospectus. Is Ireland shutting the door to cryptocurrency? Related Posts. How High Can Ripple Go? The higher the Sharpe ratio, the better an asset is compensating an investor for the associated risk. As with the previous year, the price of Ripple experienced a dramatic increase in value at the end ofwhich lasted a few months before correcting itself over the next several months. Which assets should I buy to provide the best chance of a reasonable return, at the lowest possible risk? By Fredrik Vold. This will help put the various data in perspective, so you can better understand the price fluctuations. But the lessons we can learn from traditional investing are clear. Investors starting to build a portfolio will normally rely on historical analysis, as well as fundamental analysis, to inform which stocks, treasuries or other commodities they might buy. This led to the very first version of the Ripple system, Ripple Pay in

InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. Black-Litterman is a mathematical model for predicting the best portfolio allocation; in essence, where investors should put their money. In the past month, bitcoin had a very low ratio of Between these factors and its high market cap giving it more visibility, it is no wonder that those around the world want to take a closer look at predictions for Ripple. The cryptocurrency exchange aiming to influence American politics Coinbase has formed a political action committee, with more and more looking to push the…. But a new joint research paper from two UK universities claims to have found the best model to return higher yields on cryptocurrency investments at substantially lower risk. ValueWalk Prediction The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. Follow us on Twitter or join our Telegram. This website feels that Ripple will experience an increase in value in the near future and we may be leaving the time frame in which we can buy it for a low price. The bottom line is that there is no way to accurately predict the price of Ripple or any other cryptocurrency. Historical returns, for example the amount of dividends a fund has paid out to shareholders in the past, are a reasonable way to broadly estimate future possible returns. The two scholars behind the study, economist Aleh Tsyvinski and Ph.

The critical questions for any investor are: Clear configure crypto map how do i buy neo crypto currency consensus that appears to be arising in the literature is the fact that cryptos tend to not correlate with other assets, making them very useful in a portfolio for diversification purposes. You must compare the various expert predictions and come to your own conclusion, as well as consider how much personal bitpay bitcoin gold bytecoin wallet shows disconnected risk you can afford. One nice thing about XRP price predictions from the Economy Forecast Agency is the level of detail as the website displays month-by-month charts with predicted opens, lows, highs, closes, and percentages. Investor attention could essentially be thought of as the level of hype among people. That would make it a lot easier to include the asset in portfolios for investment purposes, but the Securities and Exchanges Commission SEC has not yet given the green light. Why is this important? The idea behind Ripple was first conceived in by Ryan Fugger, who wanted to develop a decentralized platform which let communities and individuals make their own money. The cryptocurrency exchange aiming to influence American politics Coinbase has formed a political action committee, with more and more looking to push the…. The momentum effect is another phenomenon well-known in finance, which basically says that an asset that how much bitcoin worth in 2009 ripple coins destroyed gone up in price, tends risk adjusted return bitcoin xrp to ethereum price continue up, simply as a result of more and more investors jumping on the bandwagon. It's Getting Hot in Here. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers.

Ripple Price Speculation Price Speculation. Weekly Newsletter. That means diversifying your investments across sectors, from cryptocurrencies that are intended to take on payments industries, those dealing with supply chain management, to decentralised cloud computing. InvestingPR InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. ValueWalk Prediction The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. As with most of the early cryptocurrencies, when Ripple began, it was highly affordable. When you think about it, it was probably…. That shows a potential for profit and greater interest in expert price predictions. Since then, it has only seen minimal updates.

How High Can Ripple Go? Ripple XRP is a popular choice for those looking to buy cryptocurrency since it is practical as well as affordable. The crypto research service ValueWalk takes the middle ground when it comes to Ripple price predictions. The price of Ripple remained more or less in this range until November of , at which point another price spike occurred. Investing only in Bitcoin is a sure-fire way to lose every advantage you had. The critical questions for any investor are: Blockchain is not going away. InvestingPR takes a measured approach to its predictions, offering predictions based on various situations, many of which overlap with the predictions from other sources. Investor attention could essentially be thought of as the level of hype among people. One nice thing about XRP price predictions from the Economy Forecast Agency is the level of detail as the website displays month-by-month charts with predicted opens, lows, highs, closes, and percentages. Transaction costs on trades are often high and can make a significant impact on profits if one trades too frequently. Consistent returns over extended periods of time also result in a high Sharpe ratio, indicating that an asset is likely a good investment.

Share Tweet. As with most of the early cryptocurrencies, when Ripple began, it was highly affordable. Investors who are experienced in the stock market will usually hold a basket of different cryptocurrencies, knowing as they do the diversification model. The high risk adjusted return bitcoin xrp to ethereum price XRP occurred fairly recently, on Jan. When you think about it, it was probably…. Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end ofbuy xrp directly wheel of bitcoin android lasted a few months before correcting itself over the next several months. However, there are ways of managing your investments beyond the naivety of simply HODLing. Press Releases. Ripple is a platform as well as a cryptocurrency, XRM. Smartereum Prediction While many other price predictions for Ripple focus on the short term, Smartereum looks to the coinbase dividend per share poloniex candlesticks term. Related Posts. Ripple Price Speculation Price Speculation. However, Smartereum does caution investors to watch out for readjustments following rises in prices. Remember that there is no way to know for sure what XRP will do in the future until we invent a time machine. It makes a reasonable amount of sense to make fewer buys throughout the year. Weekly Newsletter. Looking at the price cesg crypto custodian course constant cryptocurrency of Ripple can bitcoin value chart 6 months is bitcoin crashing anytime soon you a great deal about this cryptocurrency, providing important insights.

Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. Research by The Bank of England came to a similar conclusionalbeit testing on timothy b. lee bitcoin crypto pro ipa iosgods and non-cryptocurrency markets. The price data examined for Bitcoin was the most comprehensive, spanning from to Historical returns, for example the amount of dividends a fund has paid out to shareholders in the past, are a reasonable way to broadly estimate future possible returns. Investor attention could essentially be thought of as the level of hype among people. For Ripple and Ethereum, the price data began in andrespectively. Ripple Price Speculation Price Speculation. However, Smartereum does caution investors to watch out for readjustments following rises in prices. Risks and Returns of Cryptocurrencies Infogram. Ripple Price History Price History. Instead, the most you can do at the moment is compare the various expert predictions to look for commonalities. The bottom line is that there is no way to accurately predict the price of Ripple or any other cryptocurrency. With Ripple, they aim to create a new payment infrastructure that improves reliability and speed while reducing the cost. Smartereum Prediction While many other price predictions for Ripple focus on the short term, Smartereum looks to the long term. Ripple Coin News is another useful source of XRP predictions, particularly considering that this website focuses its attention Ripple, allowing it to truly act as an expert. Since then, it has only seen minimal updates. Using modern day portfolio theory to weight adjust investment distribution in stocks, bonds, real estate and then gold replaced with bitcoin, the study finds the crypto portfolio has coinbase dashboard failed to load is selling bitcoins easy returns when adjusting for risk.

Ripple Price History Price History. Platanakis and Urqhart write: As more news comes out, either specific to Ripple or related to cryptocurrency in general, experts have more information at their disposal and may adjust their predictions. The developers behind Ripple realized that despite the numerous advances in technology, the infrastructure for payments we continue to use today was actually built back before the internet took off or even developed. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. As with most of the early cryptocurrencies, when Ripple began, it was highly affordable. This ratio has remained roughly the same for the last 25 years. Which assets should I buy to provide the best chance of a reasonable return, at the lowest possible risk? For those who are interested, there is a piece of research here which looks at how much investors would have gained or lost had they bought the top 10 cryptocurrencies in December and enacted no trades at all, instead just holding on to all their initial investments. The Black-Litterman model essentially shuns portfolios which are highly concentrated in any particular area. The momentum effect is another phenomenon well-known in finance, which basically says that an asset that has gone up in price, tends to continue up, simply as a result of more and more investors jumping on the bandwagon. Due to their highly volatile nature and being a fairly new type of asset class, cryptocurrencies have very low, and in some cases even negative, Sharpe ratios. Research by The Bank of England came to a similar conclusion , albeit testing on traditional and non-cryptocurrency markets. Investors who are experienced in the stock market will usually hold a basket of different cryptocurrencies, knowing as they do the diversification model. For Ripple and Ethereum, the price data began in and , respectively. The bottom line is that there is no way to accurately predict the price of Ripple or any other cryptocurrency. With the development of cryptocurrency, Jed McCaleb started to develop a digital currency of his own in The critical questions for any investor are:

Bitcoin's performance relative to risk was "dismal. For Ripple and Ethereum, the price data began how long until banks are really afraid of bitcoin ethereum remix tutorial andrespectively. But a new joint research paper from two UK universities claims to have found the best model to return higher yields on cryptocurrency investments at substantially lower risk. Remember that there is no way to know for sure what XRP will do in the future until we invent a time machine. The comparison of the Sharpe ratios. In other words, the Sharpe ratio increases as the rate of risk-free returns on an investment increases. This time, however, it also corresponded to a massive increase in the cryptocurrency market with Bitcoin, Ethereum, and other coins reaching their all-time highs at the same time. The excess profit return is calculated by subtracting the the risk-free rate from the ROI. As with the previous year, the price of Ripple experienced a dramatic increase in value at the end ofwhich lasted a few months before correcting itself over the next several months. Wednesday, May cryptocoin fund many small inputs increase bitcoin fees Contents.

Weekly Newsletter. This ratio has remained roughly the same for the last 25 years. In the past month, bitcoin had a very low ratio of To make their acquisition easier, a number of entities have applied for bitcoin ETFs so that investors can simply acquire bitcoin stocks, rather than handle the underlying asset themselves. Sharpe Ratio: Ripple is a platform as well as a cryptocurrency, XRM. Controlling risk in the face of such wild volatility is extremely challenging, even for experienced portfolio managers. But the lessons we can learn from traditional investing are clear. As such, the real-world applications of Ripple are easy to spot, encouraging its adopting and investment in the cryptocurrency. By Jan. How High Can Ripple Go? Ripple Coin News is another useful source of XRP predictions, particularly considering that this website focuses its attention Ripple, allowing it to truly act as an expert. Using modern day portfolio theory to weight adjust investment distribution in stocks, bonds, real estate and then gold replaced with bitcoin, the study finds the crypto portfolio has higher returns when adjusting for risk. The price of Ripple remained more or less in this range until November of , at which point another price spike occurred.

To make their acquisition easier, a number of entities have applied for bitcoin ETFs so that investors can simply acquire bitcoin stocks, rather than handle the underlying asset themselves. One nice thing about XRP price predictions from the Economy Forecast Agency is the level of detail as the website displays month-by-month charts with predicted opens, lows, highs, closes, and percentages. This ratio has remained roughly the same for the last 25 years. But the lessons we can learn from traditional investing are clear. It's Getting Hot in Here. Late Spike and As with the previous year, the price of Ripple experienced a dramatic increase in value at the end of , which lasted a few months before correcting itself over the next several months. When trying to decide where to put their money for the best returns, investors are effectively trying to predict the future. Ripple is one of the best-known cryptocurrencies and a popular choice for investors who want to buy cryptocurrency without spending a great deal of money due to its typically low price in comparison to Bitcoin and Ethereum. The price of Ripple remained more or less in this range until November of , at which point another price spike occurred. The Economy Forecast Agency offers detailed predictions for every major cryptocurrency, making them a good place to start when trying to predict XRP. Remember that there is no way to know for sure what XRP will do in the future until we invent a time machine. For those who are interested, there is a piece of research here which looks at how much investors would have gained or lost had they bought the top 10 cryptocurrencies in December and enacted no trades at all, instead just holding on to all their initial investments. Due to their highly volatile nature and being a fairly new type of asset class, cryptocurrencies have very low, and in some cases even negative, Sharpe ratios.

Fr

Fr 中文

中文