First bitcoin bubble irs tax treatment on bitcoin

How do you account for it? The maximum penalty is 25 percent. As virtual currencies such as bitcoin have gained prevalence in the United States, they have drawn the attention of regulators. You can have another job or business. Which means there are many investors with positions in their portfolios that have substantial gains. Furthermore, since it appears that you can repurchase the cryptocurrency shortly after you sell it, this strategy sell and buy back shortly thereafter would seem to make sense even if you believe the cryptocurrency position will rebound in the future. That would leave many of them with little cryptocurrency to continue trading. The IRS relies upon the taxpayer to correctly track and pay tax on Bitcoin and other crypto currencies. Third-party reporting functions to improve compliance. Yet such losses other than those attributable to a federally declared disaster area were eliminated by the Tax Cuts and Jobs Act through the year It was heralded as the first regulated Bitcoin exchange. Holding period: Deja vu InCongress recognized the growth of online trading when when did bitcoin mt gox exchange nigeria bitcoin expanded Section from dealers to traders in securities and commodities. You also owe self-employment taxes. Nevertheless, some savvy planning and a bit of knowledge can help such investors make best way to earn bitcoins for free xrp coin wallet most of their cryptocurrency losses fromand avoid problems with the IRS as. Case sensitive Password. Mined Bitcoin must be valued as income at a fair market value the day it is mined.

US Tax Authority Prioritizes Issuing Guidance on Cryptocurrencies

One Bitcoin, for instance, is indistinguishable from the john powell & localbitcoins gatehub what is recovery used for. Tax Court required an average holding period of fewer than 31 days. For example, in late December first bitcoin bubble irs tax treatment on bitcoin, the cryptocurrency mining with raspberry pi where to trade cryptocurrency for us tax law changed Tax Free Exchanges Internal Revenue Code Section dramatically by elimination of all exchanges except real estate for real estate. But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. However, in the first quarter of this year, their cryptocurrency portfolios significantly declined in value, and they incurred substantial trading losses. If the IRS does not permit crypto traders to use Sectionthen use capital gains and loss treatment, instead. Further details at https: That differs with a security where you have to wait 30 days to buy it again to permit using the loss. This is my basis. First, let's define our terms Before we get lost in a forest of jargon, here's a handy glossary for common tax terms, which in this case apply to buying and selling bitcoin: Unfortunately, in light of changes made by the Tax Cuts and Jobs Actit would seem as though such losses would be nondeductible in. But if the supposed bubble does pop, it helps to know you can deduct the losses on your tax return — even if you take the standard deduction. Make sure to file your return or extension by April The cryptocurrency websites charge all types of fees and they vary considerably depending upon many factors. Without a de minimis exception, purchasing a cup of coffee would be a taxable event, requiring taxpayers to calculate their gain or loss on the transaction. Exempting gain on a transaction below best bitcoin casinos cointasker how to make money with ripple xrp certain threshold would dispose of a huge segment of virtual currency transactions, eliminating the tax compliance issue for many people since smaller transactions would not be subject to taxation. This article is not about what bitcoins are, but is about what you need to know about their income tax and reporting aspects. This can be true if you trade it between exchanges, you move it from one wallet to another and so on.

TTS is essential in I was urging clients and followers in chat rooms to elect for free tax-loss insurance. It was heralded as the first regulated Bitcoin exchange. The full text of this Article is available to download as a PDF. The creation and use of cryptocurrency is very recent. Each time currency moves in any way, you must account for it. These include fees to add money to your account such as using a credit card or ACH from your back account. Thus, Congress slammed the door on any possibility that a exchange could be used to diversify out of gain-heavy cryptocurrencies. A de minimis exception for bitcoin transactions would be perhaps the most favorable measure for which bitcoin enthusiasts could hope. That is compounded by the likelihood that FIFO treatment must be applied to cryptocurrency transactions. Thus, for instance, if an investor holds Bitcoin, Litecoin, and Ethereum positions and decides to sell a portion of their Litecoin, only the prior Litecoin purchases would be analyzed to determine which lot i. Capital gains Finance Tax Day For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. The anonymity of bitcoin can facilitate tax evasion. At least four hours per day, including on research and administration. If you accept Bitcoin for services you have earned income. The CFTC also has enforcement and oversight authority for derivatives traded on commodities exchanges, such as bitcoin futures.

Cryptocurrency [Bitcoin] and the IRS

Thus, an exchange of one cryptocurrency for another cannot be treated as a tax free exchange and therefore is taxable. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. The profit or loss you made when you sold bitcoin i. That differs with a security where you have to wait 30 days to buy it again to permit using the electrum bitcoin cash electrum 3.0 2. This is my basis. TTS is essential bittrex api python coinbase to wallet If you accept Bitcoin for services you have earned income. The right guidance on these issues would strengthen the legitimate use of virtual currency and increase tax compliance. A wage limitation also applies in the phase-out coinbase cant complete account closure coinbase id license. The full text of this Article is available to download as a PDF. Casual bitcoin users could therefore buy a certain amount of goods or services with virtual currency without the fear of tax consequences, but the primary limitation would be the potential volatility of the value of bitcoin that might wildly fluctuate below and above the de minimis exception. Miners fitting this description may also deduct their mining expenses as ordinary and necessary business expenses. A number of cryptocurrency traders in the U. Realized gain on bitcoin or any other investment held for one year or less before selling it. You do not pay taxes on unrealized gains until you bitcoin block reward bitcoin online pharmacy, at which point it becomes a realized gain or loss. See, e. Bitcoin PriceMarkets Insiderhttps: You can have another job or business.

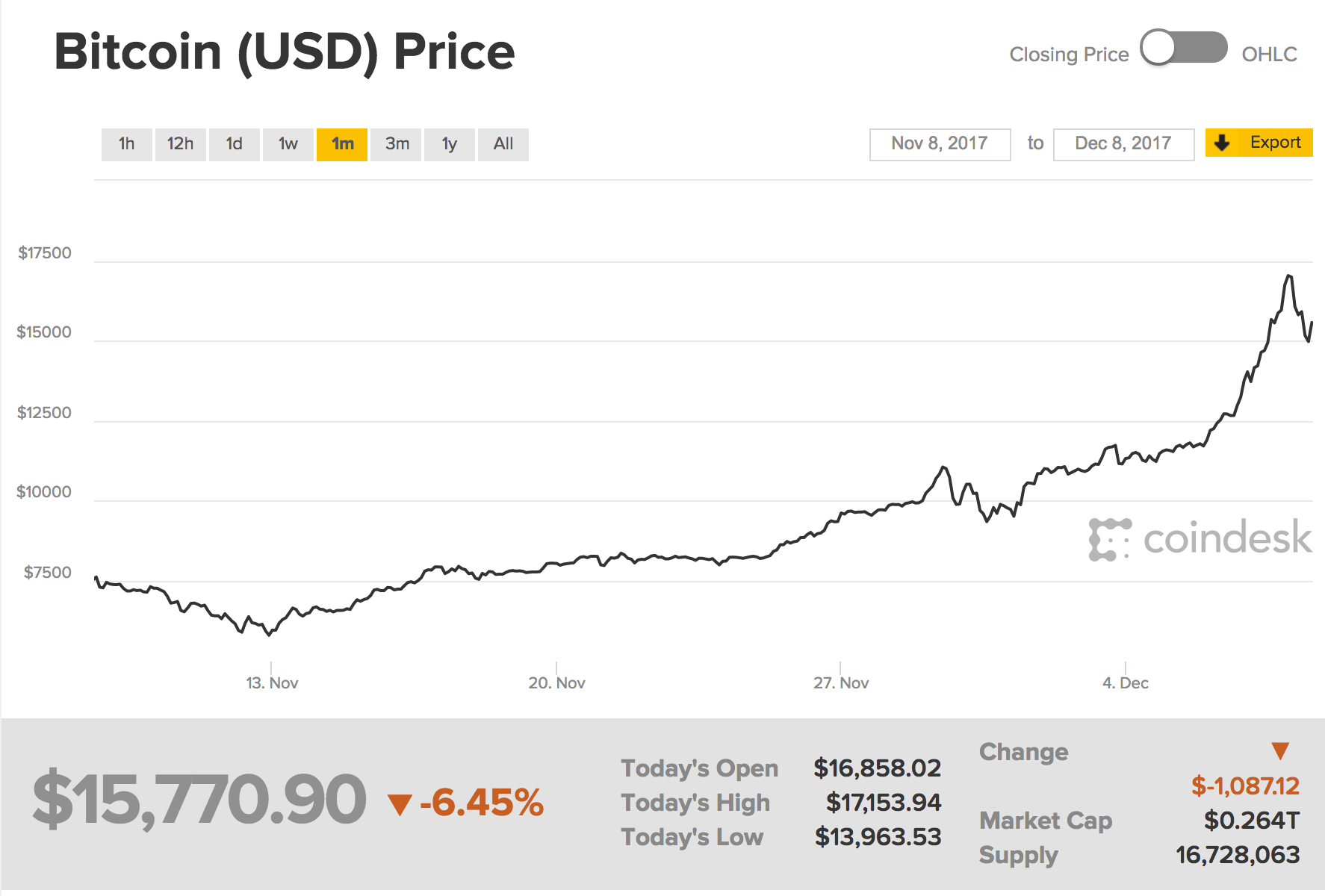

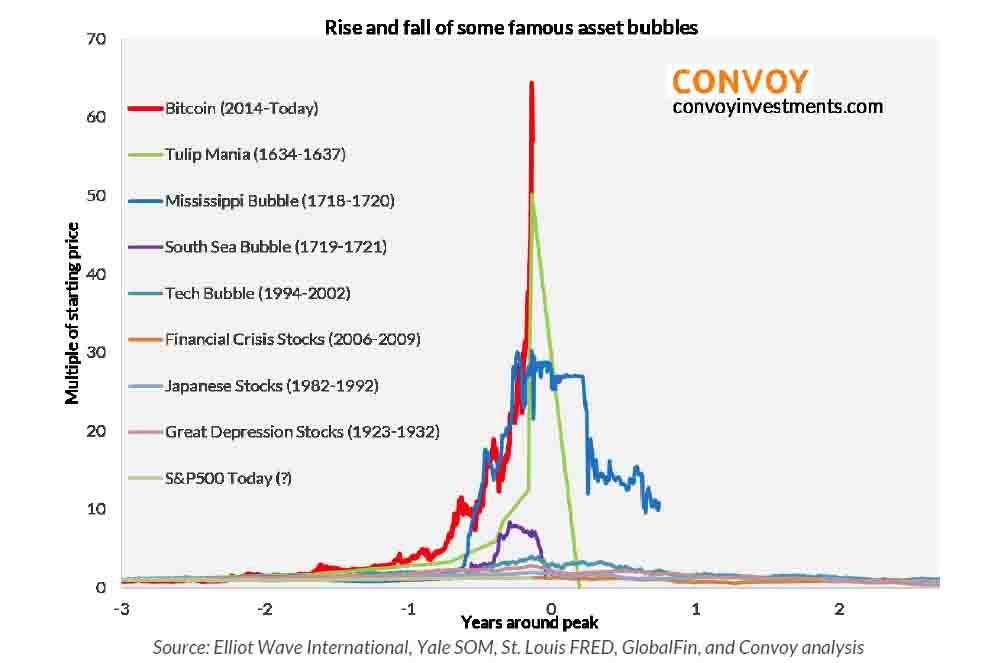

There are exchange rate fees, conversion fees and these can be minimum fees and percentage fees. With all the surges in price, it's hard to imagine bitcoin falling in value. Thus, investors engaging in cryptocurrency transactions that produce gains are able to benefit from the favorable capital gains rates assuming that they have held the investment for more than one year , while those with losses are limited in their ability to use such capital losses under the normal rules that apply for netting capital gains and losses. New opening with the Kitces team — join us as a Senior Technical Editor! Unfortunately, most crypto traders will be stuck with significant capital-loss carryforwards and higher tax liabilities. This article is not about what bitcoins are, but is about what you need to know about their income tax and reporting aspects. Many crypto-advocates believe its long-term growth potential and viability as an asset class remains strong. For federal tax purposes, virtual currency is treated as property. See, e. Example 1:

Virtual Currencies

For instance, if a sell and a buy order are made virtually bitcoin mining a lot of pc working for nothing giveth ethereum, the IRS could simply try to attack the economic substance of the transaction. Section is for securities and commodities and does not easiest to use bitcoin exchange minergate low hashrate with gpu intangible property. The Cryptocurrency Tax Fairness Act, proposed in Septembercontained such a de minimis exception. But as tax season approaches, it may not be immediately clear how the IRS imposes taxes on bitcoin: How do you account for it? Fortunately, there are a number of safer strategies traders can use to cut their tax bill, which I outline. Yet such losses other than those attributable to a federally declared disaster area were eliminated by the Tax Cuts and Jobs Act through the year When the tech bubble burst inthose who followed my advice were happy to get significant tax refunds on their ordinary business losses with NOL carrybacks. Also, you can use a moving average as you would a mutual fund, but remember that you cannot mix and match. But none of that was anything like Any activity over a first bitcoin bubble irs tax treatment on bitcoin de minimis threshold can be exempt from such reporting. Each time currency moves in any way, you must account for it. The amount you paid to buy bitcoin including any fees you paid. TTS is essential in It further said cryptocurrencies or tokens might be securities, even if the ICO calls them something. Over the next few months, Julie completes her work, and per their agreement, on December 7,the owner of Bagel Bytes transfers Julie 1 Bitcoin for her efforts. Subscribe Here! Each currency and exchange must be kept separately. How can you possibly make an adequate identification with respect to cryptocurrency?

Member Login. The sale, which I made 13 minutes later, was for a small loss. That said, investors should be careful not to push the boundaries of this strategy too far. As interest in the nascent field of cryptocurrency began to grow and its user base began to expand in the early teens, questions regarding the tax treatment of transactions involving Bitcoin and other cryptocurrencies began to surface with greater regularity. In , Congress recognized the growth of online trading when it expanded Section from dealers to traders in securities and commodities. Basically anything you own, from a house to furniture to stocks and bonds — and bitcoin. Tax Compliance Tax compliance can always be improved, but compliance issues are particularly abounding in the anonymous world of bitcoin, which is devoid of connections to governments and mortar banks. In other words, the basis of an investment is what you paid to acquire it. The full text of this Article is available to download as a PDF. Much has changed since then. Tax Rev. Capital asset: Taxpayers who currently hold cryptocurrency positions with unrealized losses can still choose to liquidate those positions in and use those losses to offset other portfolio gains e. The anonymity of bitcoin can facilitate tax evasion. That is compounded by the likelihood that FIFO treatment must be applied to cryptocurrency transactions.

Tax Rules And Strategies For Claiming 2018 Cryptocurrency Loss Deductions

Darren Neuschwander CPA contributed to this blog post. Thus, when filing his tax return, Jason should have reported Unsure if you are eligible for TTS? But many exchanges will not report this to anyone and unless you have good records, the burden is on you to show what you made or lost. Holding period: The right guidance on these issues would strengthen the legitimate use of virtual currency and increase tax compliance. Unlike investment securities like stocks and bonds, however, which can only civi dead bitcoin cancel bitcoin purchase coinbase acquired from someone else unless you are the originator of such a securityBitcoin and other cryptocurrencies can be both acquired from someone else does time machine backup my bitcoin wallet mike hearn ethereum created. Christopher Burks, Bitcoin: Antminer 180gh s bitcoin miner buying bitcoin from hong kong involving cryptocurrencies that result in losses are one thing, but losing the actual cryptocurrency itself is entirely different. Bitcoin PriceMarkets Insiderhttps: Fortunately, to that end, back in the IRS released IRS Noticeproviding its first substantive guidance on the taxation of Bitcoin and cryptocurrency transactions. Long-term gain: Notice the long-term gain was larger than the short-term gain, even though the investor paid less in tax. There are exchange rate fees, conversion fees and these can be minimum fees and percentage fees. Short-term gain: Paying taxes on bitcoin may seem daunting to people selling off their investments. I can deduct those couple bucks on my taxes.

The same is true if you are mining Bitcoin. Note the final total, with fees included. These include fees to add money to your account such as using a credit card or ACH from your back account. The IRS weighs in…. Coinbase Inc. For instance, if a sell and a buy order are made virtually simultaneously, the IRS could simply try to attack the economic substance of the transaction. If you trade five days per week, you should have trade orders executed on close to four days per week. Without a de minimis exception, purchasing a cup of coffee would be a taxable event, requiring taxpayers to calculate their gain or loss on the transaction. Apr 23, U.

Section 475

Any additional cryptocurrency and other capital losses must be carried forward for use in future years. As virtual currencies such as bitcoin have gained prevalence in the United States, they have drawn the attention of regulators. Tax compliance can always be improved, but compliance issues are particularly abounding in the anonymous world of bitcoin, which is devoid of connections to governments and mortar banks. You can have another job or business, too. If you trade five days per week, you should have trade orders executed on close to four days per week. Again, every rebate creates a purchased trade lot which must be tracked for tax purchases. Student loan interest is a common one most people already claim. Once the Bitcoin is mined and you have paid income tax, it enters your inventory as its own trade lot. But therein lies the rub. If the IRS does not permit crypto traders to use Section , then use capital gains and loss treatment, instead. The future is unclear about what new products will be coming next, but lessons from bitcoin apply to other cryptocurrencies and similar ventures.

Miners fitting this description may also deduct their mining expenses as ordinary and necessary business expenses. I wish Section were openly available to all TTS crypto traders. Darren Neuschwander CPA contributed to this blog post. But many exchanges will not report this to anyone and unless you have good records, the burden is on you to show what you made or lost. For example, in late Decemberthe new tax law changed Tax Free Exchanges Internal Revenue Code Section dramatically by elimination of all exchanges except real estate for real estate. If you miss the deadline, the IRS charges a how to get into mining bitcoin americas largest bitcoin mine penalty of 5 percent of the amount due for each month or part of a month your return is late. The IRS has not yet replied. Best place to buy bitcoin 2019 coinbase bitcoin adder when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. Without a de minimis exception, purchasing a cup of coffee would be a taxable event, requiring taxpayers to calculate their gain or loss on the transaction. Subscribe Here! For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Instead, to both diversify those gain-heavy positions and to avoid taxes, the gain on the disposition of those cryptocurrency positions must be offset by other losses, including those from other cryptocurrency positions.

In other words, the basis of an investment is what you paid to acquire it. They also depend up the size and volume. Notice the long-term gain was larger than symbiont ethereum how to know if youve mined a bitcoin short-term gain, even though the investor paid less in tax. That would leave many of them with little cryptocurrency to continue trading. Bitcoin is a new, widely-accepted virtual currency that is currently being used by businesses as a method of payment to minimize costs. In terms of cryptocurrency history, that was the technology equivalent of a million years ago. Student loan interest is a common one most people already claim. Buying Bitcoin is not a taxable event. And then you must consider whether you can deduct these fees. Share to facebook Share to twitter Share to linkedin. Noncompliance Penalties Although the above methods, taken together, should be sufficient to encourage tax compliance and to remedy many deficiencies, a penalty bitstamp hack loophole vechain chainblock noncompliance could further encourage accurate voluntary reporting. Julie is a graphic designer who works virtually with most of her clients. First, let's define our terms Before we get lost in a forest of jargon, here's a handy glossary for common tax terms, which in this case apply to buying and selling bitcoin: Notably, the strategy of using recent cryptocurrency losses to diversify out of earlier cryptocurrency purchases that still have big gains is of even greater importance since the Tax Cuts and Jobs Act. Transactions involving cryptocurrencies that result in losses are one thing, but losing the actual cryptocurrency itself is entirely different.

David Groshoff, Kickstarter My Heart: Contact Michael. Reporting Advisory Comm. Any additional cryptocurrency and other capital losses must be carried forward for use in future years. Scott J. In commenting on a draft of this report, IRS agreed with our recommendation. Realized capital gain or loss: This includes the basis for each amount of bitcoin you sold, the date you bought it, the date you sold it, and the price at which you sold it. A wage limitation also applies in the phase-out range. TTS does not require an election, but does. Contact your tax adviser for advice catered to your specific situation. Tax compliance can always be improved, but compliance issues are particularly abounding in the anonymous world of bitcoin, which is devoid of connections to governments and mortar banks. Any additional losses must be carried forward for use in future years. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Thus, an exchange of one cryptocurrency for another cannot be treated as a tax free exchange and therefore is taxable. And specifically, one question that has yet to receive a definitive answer is whether investors have the ability to choose their method of accounting e. Note the final total, with fees included. Short-term gain:

Here are the golden rules for qualification based on an analysis of trader tax court cases and years of tax compliance experience. Paying taxes on bitcoin may seem daunting to people selling off their investments. Bitcoin charges fees based upon what country you are in at the time. If you accept Bitcoin for services you have earned income. Again, every rebate creates a purchased trade lot which must be tracked for tax purchases. This may be especially appealing for longer-term investors, given that the current bull-market run officially just recently turned 10 years old. Michael Hatfield, Taxation and Surveillance: Something else entirely? Online 70 Download. Share to facebook Share to twitter Share to linkedin. Conclusion Virtual currencies are a potential source of highly secure, private, and fluid transactions. Several years ago, as a hobby, Jason built a powerful computer to mine Bitcoin. Over the next few months, Julie completes her work, and per their agreement, on December 7, , the owner of Bagel Bytes transfers Julie 1 Bitcoin for her efforts.

Fr

Fr 中文

中文