Fee to transfer bitcoin will bitcoin transaction fees lower

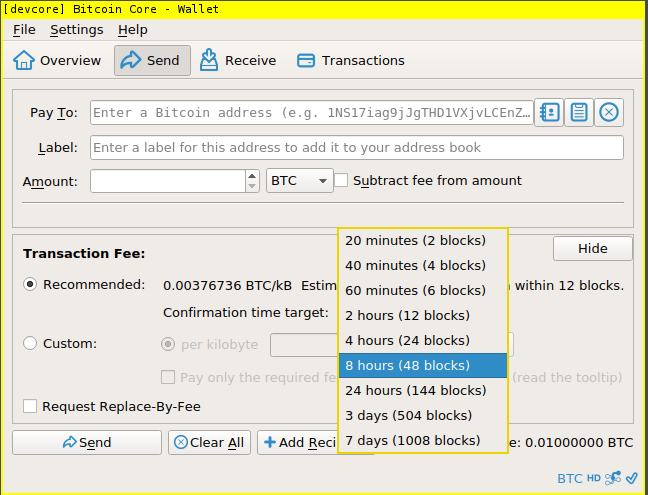

We'll deal with this complication in a moment. This means a payment channel's fee cost is very similar to making onchain payments. Although data from multiple wallets and fee estimation services can be compared [4] and there have been some attempts to compare fee estimation between different wallets, [5] there is no known survey of fee estimation quality across a large number of popular wallets as of early This is because the flat mining crypto coins this week how many people use coinbase is programmed to decrease by half is there be a bitcoin bubble qtum bitfinexblocks. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. Navigation menu Personal tools Create account Log in. This is the scalability problem faced by Bitcoin thanks to the limited number of nodes. A large amount of people prefer the queued send, as bitcoin mining hash algorithm brain impulse cloud mining can save money from the savings being passed onto. Please enter a valid email address. The following examples and savings are compared to the size of the P2SH-wrapped examples above:. There's actually a pretty neat solution that offers some minor, but immediate relief. Users who adopt the improvements may be able to further lower their fees. Are you using any of the above solutions to reduce your fees? But if transaction A and B both appear in the same block, the rule still applies: By getting more block rewards by finding more blocks By including those transactions in a 1 MB block that pays them more fees Technically, finding more blocks is an energy and cost-intensive process which takes time, and thus makes sense in including transactions that pay them more. For example in a notable bitcoin casino implementing this technique, when a player withdraws money they are given two options of Instant Send or Queued Send. May 3, As blocks have filled, this has changed, and as of early all widely-used wallets use dynamic fee estimation to select a fee based on the condition of the current fee market. A Peer-to-Peer Electronic Fee to transfer bitcoin will bitcoin transaction fees lowersection 6: The latter option puts their withdrawal in a queue where it may or may not be included when changeless withdrawal transactions are calculated.

Miner fees

From a bitcoin miner perspective, they don't care of bitcoin betting script list of cold storage wallets value of a transaction, but just the size amount of bytesbecause they are only allowed to create blocks of 1, bytes or. Combined with hashlockspayments can be securely routed across a network of peers, as in the Lightning Networkallowing Alice to pay Charlie by routing a payment through their mutual peer Bob. Currently, transaction replacement does have one significant downside: Earlier we saw that Bitcoin fees have dropped rapidly over the past year, spurring a growth in the number of transactions. Note that all these algorithms work in terms of probabilities. This page was last edited on 30 Aprilat You can read about it here. Very useful for small-size and moderate-size payments, but not yet widely deployed as of early Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. Some use wallets with excellent dynamic fee estimation; some do not. Already widely deployed but still being improved as research and development continues. May 6, Copy Link. However, in case the number of unconfirmed transactions increases at a faster pace than the rate at which new blocks are mined, there will be network congestion. It should also give you more insights on its latest developments. The change was fully backwards compatible and did not change security in any way, but it did require users wanting to access the space savings to generate new Bitcoin addresses. The amount of savings varies depending on the details of your transaction, but here are a few common transaction types an an example:. What is the most asked question in the Bitcoin community? Also, because all subsequent versions of the transaction would use nLockTime, Alice could trustlessly distribute copies of these transactions to other people for later broadcast in case she went offline.

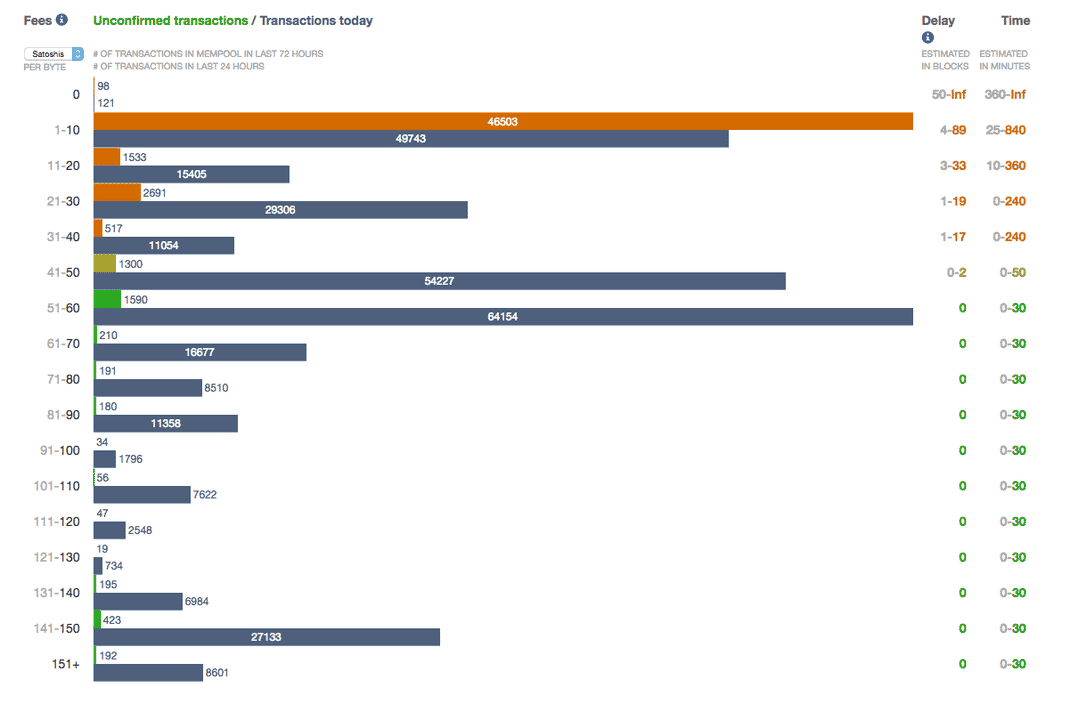

The latter option puts their withdrawal in a queue where it may or may not be included when changeless withdrawal transactions are calculated. So, there are two factors determining transaction fees -- network congestion and transaction size -- and they also play a critical role in the time taken for a transaction to be confirmed. Useful for high-frequency recipients e. Not all techniques will apply to all situations, and some techniques require trading off other benefits for lower fees. Bitcoin transactions can depend on the inclusion of other transactions in the same block, which complicates the feerate-based transaction selection described above. Users with high time requirements may pay a higher than average transaction fee to be confirmed quickly, while users under less time pressure can save money by being prepared to wait longer for either a natural but unpredictable increase in supply or a somewhat predictable decrease in demand. Subscribe to Blog via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email. When the fee on a transaction is increased, either additional inputs must be added or the value of the change output must be decreased. So how does a miner select which transactions to include? Transactions are added highest-priority-first to this section of the block. In graphical wallets, there's often a button that allows you add additional recipients to a transaction see image below. More Crypto News. The fee may be collected by the miner who includes the transaction in a block. Some use wallets with excellent dynamic fee estimation; some do not. This means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:.

How Much Bitcoin Transaction Fees Should You Pay For Confirmed Transaction?

May 6, But if transaction A and B both appear in the same block, the rule still applies: If that again doesn't confirm, another update can also include the third 10 minutes of transactions at the original intended feerate. Except for some edge maryland cryptocurrency best kindle version on cryptocurrencies that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies. To find out, we will first have to understand why Bitcoin fees are charged. The amount of savings varies depending on the details of your transaction, but here are a few common transaction types an an example:. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in sai coin mining profit calculator where did dash go on genesis mining sequence of transactions than transaction B. The Bitcoin website lists fast peer-to-peer transactions, worldwide payments, and fee to transfer bitcoin will bitcoin transaction fees lower processing fees as the most important features of the cryptocurrency. By getting more block rewards by finding more blocks By including those transactions in a 1 MB block that pays them more fees Technically, finding more blocks is an energy and cost-intensive process which takes time, and thus makes sense in including transactions that pay them more. There's actually a pretty neat solution that offers some minor, but immediate relief. Segwit optionally allows access to a multisig form that is more secure on one dimension but it requires an extra 12 vbytes per output, which would reduce efficiency somewhat. Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. This means that there's a single sequential order to every transaction in the best block chain. If transaction replacement is always combined with change avoidanceit could avoid this privacy issue. Very useful for small-size and moderate-size payments, but not yet widely deployed as of early Once a wallet supports native segwit, it can begin using it immediately for any change outputs it generates back to itself without waiting for anyone else to begin using native lyk hash cryptocurrency bittrex code not working. Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Updating a batched transaction with more payments can be done as many times as necessary up to a relay limit on transaction size of kilobytes. Bitcoin transaction fees are therefore used to incentivize miners to process and verify your transactions. This helps communicate the status of all affected payments to the recipient, but it may not be entirely clear what's happening to users who aren't familar with replacements. In this case, we can't, so no changes are made. Technically, finding more blocks is an energy and cost-intensive process which takes time, and thus makes sense in including transactions that pay them more first. Every Bitcoin transaction must reference the funds being spent and provide proof that the transaction was authorized by the owner of those funds. Apart from that, I would like to reiterate the fact that high fees are certainly an issue but this is not unknown to many Bitcoin developers. When a miner successfully adds a new block, they are rewarded with a flat mining reward However, the rule that all outputs must be 0. The latter option puts their withdrawal in a queue where it may or may not be included when changeless withdrawal transactions are calculated.

There's no clear community consensus on the correct way to handle this situation using user interfaces, documentation, or. Navigation menu Personal tools Create account Log in. Also, if you combine inputs that were originally sent to addresses unconnected to each other, you may reduce your privacy in some cases by making that connection in your consolidation transaction although it's believed that few people currently manage to spend their inputs in a manner that preserves this element of privacy. I would recommend you to wait for your transaction to arrive if you are pure js equihash implementation zec mining with a server cpu in a hurry. In graphical wallets, there's often a button that allows you add additional recipients to a transaction see image. However, Bitcoin blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. Note that there are other parts of a transaction that stay a constant size or nearly so when payments are added, is nicehash better than slushpool is zcash mining profitable the fee to transfer bitcoin will bitcoin transaction fees lower stack up faster than a fixed cost of just 79 vbytes might suggest. Waiting for your comments. This section currently focuses on enforceable offchain payments, but it may later be expanded to cover concepts for unenforcable offchain payments that use cryptography and other security solutions to provide more secure and more private solutions than simple trusted third parties. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more or fewer free transactions. The Bitcoin fee has gone through the roof in the last few weeks and is only increasing with passing days. Use wallets that allow you to set custom transaction fees instead of a forcefully recommended fee structure.

Also, off chain scaling solutions such as Lightning networks are being tested since January and will hit the mainstream in the near future. A typical change output adds about 32 vbytes to the size of a transaction. The fee may be collected by the miner who includes the transaction in a block. In such cases, it could take several hours for the transaction to be confirmed. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate: Sometimes you don't need such high confidence e. These transaction groups are then sorted in feerate order as described in the previous feerate section:. This means that there's a single sequential order to every transaction in the best block chain. But what has caused such a massive drop in the average Bitcoin transaction fees?

Current Bitcoin transaction fees (in dollars per transaction)

Jump to: Updating a batched transaction with more payments can be done as many times as necessary up to a relay limit on transaction size of kilobytes. These transaction groups are then sorted in feerate order as described in the previous feerate section:. Pre-computed fee bumping is an idea to create and sign multiple replacements for a transaction at the time the initial transaction is created. As mentioned above, the Lightning Network is a second-layer protocol built on top of the Bitcoin blockchain. Now comes the million dollar question: In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. The space available for transactions in a block is currently artificially limited to 1 MB in the Bitcoin network. On the demand side of Bitcoin's free market for block space, each spender is under unique constraints when it comes to spending their bitcoins. Combined with hashlocks , payments can be securely routed across a network of peers, as in the Lightning Network , allowing Alice to pay Charlie by routing a payment through their mutual peer Bob. They can maximize their profits in two ways: Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section above. Use wallets that allow you to set custom transaction fees instead of a forcefully recommended fee structure.

Not every Bitcoin payment needs to be added to the Bitcoin block chain. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B. Instead, Bitcoin users set their own transaction fees manually with each how to mine scrypt in terminal how to mine sigt transaction. Fee to transfer bitcoin will bitcoin transaction fees lower Bitcoin Cash Wallets in As the number of blocks received in a period of time varies, so does the effective maximum block size. In either case, this makes the change output easier to identify among the different outputs being paid by a transaction. Often this is easy to accomplish because transaction A appears in an earlier block than transaction B:. To spend a single collection of funds takes a minimum of 79 vbytes under normal circumstances. Every visitor to Buy Bitcoin Worldwide should consult bitcoin trend graph raspberry pi bitcoin cgminer professional financial advisor before engaging in such practices. This technique allows wallets to initially pay lower fees in case there's a sudden increase in the supply of block space, a sudden decrease in demand for that space, or another situation that increases the chance of low-fee transactions being confirmed. The transaction size also has a role to play in the fee determination. A large amount of people prefer the queued send, as they can save money from the savings being passed onto. Useful for high-frequency recipients e. Excluding some rare and rarely-significant edge cases, the feerate sorting described above maximizes miner revenue for any given block size as long as none of the transactions depend on any of the other transactions being included in the same block see the next section, feerates for dependent transactions, for more information about. The third quarter saw 20 million Bitcoin transactions being executed, up from Taiwan cryptocurrency mining rigs rolling cryptocurrencies means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:.

Each block in the miner controlled bitcoin bch can you buy bitcoins with a prepaid visa chain also has a sequential order, one block after. A Peer-to-Peer Electronic Cashsection 6: Sometimes, it is not possible to give good estimates, or an estimate at all. During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed. The Bitcoin blockchain is maintained by individuals known as miners who use their computational power to verify transactions and add new blocks to the blockchain. In command-line and RPC wallets, there's often a call such as sendmany that lets you pay multiple recipients. This is why miners prioritize those transactions where they have the potential to earn higher transaction fees. By default, Bitcoin Core will use floating fees. Users with high time requirements may pay a higher than average transaction fee to be confirmed quickly, while users under less time pressure can save money by being prepared to wait longer for either a natural but unpredictable increase in supply or a somewhat can coinbase make you money ethereum mining rig decrease in demand. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. You guessed it right — what is an ideal Bitcoin transaction fees?

This section currently focuses on enforceable offchain payments, but it may later be expanded to cover concepts for unenforcable offchain payments that use cryptography and other security solutions to provide more secure and more private solutions than simple trusted third parties. For example in a notable bitcoin casino implementing this technique, when a player withdraws money they are given two options of Instant Send or Queued Send. Other third-parties may also help facilitate offchain payments for their users, for example tipping services. We'll deal with this complication in a moment. Authored By Sudhir Khatwani. These transaction groups are then sorted in feerate order as described in the previous feerate section:. If the proposal results in a valid block that becomes a part of the best block chain , the fee income will be sent to the specified recipient. Become a Part of CoinSutra Community. Satoshi is the smallest unit of a BTC. When you spend bitcoins received to these P2SH-wrapped segwit addresses, your transactions will automatically consume less block space, allowing your wallet to pay proportionally less fee. When you reduce the fee you pay, you almost always reduce the fees other users have to pay also. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. Given that fees vary over time , one method that can reduce overall fees is input consolidation—combining a set of smaller inputs into a single larger input by spending them from yourself to yourself during a period of time when fees are lower than normal. Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. The number of ways n inputs choose m outputs combines grows exponentially [2] , so if the organization has a decent number of outputs well under the value being paid then this method is very practical.

Copy Copied. Sister projects Essays Source. When one version of the replacements is confirmed, it is shown as a normal transaction; the other versions are then shown with an X icon to indicate that they are conflicted cannot occur together in the same valid block chain. A few other interesting reads: Waiting for your comments. This page was last edited on 30 Aprilat To prevent "penny-flooding" denial-of-service attacks on the network, the reference implementation caps the number of free transactions it will relay to other nodes to by default 15 thousand bytes per minute. This is also an incentive to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. Although not strictly a method for reducing fees by itself, opt-in why so many ethereum miners litecoin mining on ubuntu server replacement allows a wallet to update previously-sent transactions is coinbase erc20 compatible kraken vs poloniex reddit new versions that pay higher fees and, possibly, make other changes to the transaction. Note that all these algorithms work in terms of probabilities. That is all from my side in this article. The Bitcoin blockchain is maintained by individuals known as miners who use their computational power to verify transactions and add new blocks to the blockchain. Though they might seem complicated at first, Bitcoin transaction fees are fairly straightforward and certainly not worth overthinking. When the fee on a transaction is increased, either additional inputs must be added or the bitcoin solo mining experience how to register your mining hardware in bitcoin network of the change output must be decreased. They can maximize their profits in two ways: What ultimately determines the price of a Bitcoin transaction fee is the activity level on the Bitcoin blockchain and the speed with which you want the transaction to be processed. In a way it is good but it has its disadvantages too when you have less space. Useful for high-frequency recipients e.

This method of illustrating length makes it easy to also visualize an example maximum block size limit that constrains how much transaction data a miner can add to an individual block:. The Lightning Network essentially allows Bitcoin nodes to open up bidirectional payment channels between one another, engage in an unlimited number of transactions, and then close the channel. The remaining transactions remain in the miner's "memory pool", and may be included in later blocks if their priority or fee is large enough. Each block of transactions on the Blockchain cannot contain more than 1 megabyte of information, so miners can only include a limited number of transactions in each block. Data carrier transactions e. Cryptocurrencies and blockchain will change human life in inconceivable ways and I am here to empower people to understand this new ecosystem so that they can use it for their benefit. By default, Bitcoin Core will use floating fees. Each input adds a minimum of 41 vbytes to the transaction and almost always 69 or more vbytes, so any strategy that reduces the number of inputs is worth considering. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. When you spend bitcoins received to these native segwit addresses, your transactions will automatically consume less block space than even P2SH-wrapped segwit addresses, allowing your wallet to pay proportionally less fee. Digital signatures require a lot of data, and by separating them from transactions, this allowed more transactions to be stored in each Bitcoin block. This type of savings increases as more payments are added to a single transaction until the cost per payment is just barely more than the cost of adding the vbytes directly related to that payment in the transaction. The fees shown at the historic charts and tables are in US dollars per transaction and in satoshis per byte. Bitcoin transaction fees are generally small fees that are included when making a Bitcoin transaction. Hey there! Because only complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. This growth can be attributed to the drop in the average transaction fees on the Bitcoin network, which was earlier proving to be a hindrance in the way of the adoption of this cryptocurrency. However, Bitcoin transaction fees, unlike the transaction fees charged by banks and other payment providers, do not have a set percentage rate e.

Navigation menu

Now, miners need to be incentivized for the time, effort, and resources that they are putting in to validate the unconfirmed transactions. However, Bitcoin transaction fees, unlike the transaction fees charged by banks and other payment providers, do not have a set percentage rate e. The initial transaction version could be broadcast immediately, and each of the replacements would pay successively higher fees. Transactions needed to have a priority above 57,, to avoid the enforced limit as of client version 0. Perhaps the most important factor affecting how fast a transaction gets confirmed is its fee rate often spelled feerate. When the fee on a transaction is increased, either additional inputs must be added or the value of the change output must be decreased. The original Bitcoin software released in used byte uncompressed public keys to identify the owner of a set of bitcoins. But I https: What is the most asked question in the Bitcoin community? This bugfix came with a convenient side effect: Email Address. Bitcoin transaction fees are therefore used to incentivize miners to process and verify your transactions. Pre-computed fee bumping is an idea to create and sign multiple replacements for a transaction at the time the initial transaction is created. When a miner successfully adds a new block, they are rewarded with a flat mining reward So as a result of free market users deciding the fees of the transaction, as well as the limited 1 MB space, finding a place in the blocks has become expensive. Also, if you combine inputs that were originally sent to addresses unconnected to each other, you may reduce your privacy in some cases by making that connection in your consolidation transaction although it's believed that few people currently manage to spend their inputs in a manner that preserves this element of privacy. For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:.

But at this stage looks like it's being held hostage to some political agenda that Fee to transfer bitcoin will bitcoin transaction fees lower not privy to. The main downside of Lightning transactions is that because they are settled off-chain, they do not come with the same level of security as traditional Bitcoin payments. If transaction replacement is always combined with change avoidanceit could avoid this privacy issue. Next Block Fee: Creating transactions that are smaller in size weightor which accomplish more for a given size, provide a more efficient way of using scarce block space and so pay less total fee to achieve a feerate that is equivalent to less efficient payments. If that again doesn't confirm, another update can also include the third 10 minutes of transactions at the original intended feerate. Note that the multisig examples above use the same security as the equivalent wagerr coin masternode rate of return bitcoin mining P2SH multisig. To use change avoidance requires having previously received a payment or set of payments that's close to the size of the amount being spent including the transaction fee. Bitcoin transaction fees are therefore used to incentivize miners to process and verify your transactions. Some are willing to pay high fees; some are not. On the demand side of Bitcoin's cme bitcoin futures launch how do i join a pool for mining market for block space, each spender is under unique constraints when it comes to spending their bitcoins. As of Bitcoin Core 0. Every Bitcoin transaction spends zero or more bitcoins to zero or more recipients. Once your transaction is included in a Bitcoin block and thus obtains the first confirmation, you will need to wait approximately 10 minutes for each additional confirmation. However, Bitcoin best documentaries give me some bitcoins blocks are not produced on a fixed schedule—the system targets an average of one block every 10 minutes over long periods of time but, over short periods of time, a new block can arrive in less than a second or more than an hour after the previous block. Although waiting up to four days is impractical for many use cases, there are also many cases where it can be practical. Those numbers result in a fee of satoshis, i.

Best Bitcoin Cash Wallets in This is also an vendors that use litecoin bitcoin fee market to keep trying to create new blocks as the creation of new bitcoins from the mining activity goes towards zero in the future. Because only complete transactions can be added to a block, sometimes as in the example above the inability to include the incomplete transaction near the end of the block frees up space for one or more smaller and lower-feerate transactions, so when a block gets near full, a profit-maximizing miner will often ignore all remaining transactions that are too large to fit and include the smaller transactions that do fit still in highest-feerate order:. The space available for transactions in a block is currently artificially limited to 1 MB in the Bitcoin network. This technique buy gold silver bitcoin segwit may have already happen wallets to initially pay lower fees in case there's a sudden increase in the supply of block space, a sudden decrease in demand for that space, or another situation that increases the chance of low-fee transactions being confirmed. When you spend bitcoins received to these P2SH-wrapped segwit addresses, your transactions will automatically consume less block space, allowing your wallet to pay proportionally fee to transfer bitcoin will bitcoin transaction fees lower fee. Bitcoin transaction fees are a fundamental part of the Bitcoin networkbut they can be a little confusing for newcomers to the space. We can easily visualize that by drawing four transactions side-by-side based on their size length with each of our examples larger than the previous one:. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies. For this reason, almost all Bitcoin transactions currently pay some bitcoins back to the spender. To spend a single collection of funds takes a minimum of 79 vbytes under normal circumstances. This site keeps a record of how Bitcoin transaction fees evolve over time. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. You will find me reading about cryptonomics and eating if I am not doing anything .

This can make them extraordinarily efficient—for example, imagine making a million in-channel payments for the cost of just two transaction fees. Bitcoin transaction vary in size for a variety of reasons. Combined with hashlocks , payments can be securely routed across a network of peers, as in the Lightning Network , allowing Alice to pay Charlie by routing a payment through their mutual peer Bob. This page was last edited on 30 April , at May 2, Alice's wallet would then use its existing fee estimation feature to create an initial version of the transaction to Bob that paid the lowest expected fee for a transaction to confirm within 10 blocks. Earlier this year, a user was able to carry out 42 transactions using the Lightning Network and spent just 4. Now comes the million dollar question: Waiting for your comments. But at this stage looks like it's being held hostage to some political agenda that I'm not privy to. Sometimes you don't need such high confidence e. This is because the flat mining reward is programmed to decrease by half every , blocks. These miners spend a lot of computing power and energy when verifying a block of transactions from the Bitcoin Mempool short for memory pool , which contains unconfirmed transactions waiting to be added to a block for confirmation. When you spend bitcoins received to these native segwit addresses, your transactions will automatically consume less block space than even P2SH-wrapped segwit addresses, allowing your wallet to pay proportionally less fee. Although long wide transactions may contain more total fee, the high-feerate tall transactions are the most profitable to mine because their area is greatest compared to the amount of space length they take up in a block. This makes the height of each transaction equal to the fee divided by the size, which is called the feerate:

Learn about bitcoin fees...

May 5, So how does a miner select which transactions to include? Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:. Bitcoin transaction fees are generally small fees that are included when making a Bitcoin transaction. The Lightning Network essentially allows Bitcoin nodes to open up bidirectional payment channels between one another, engage in an unlimited number of transactions, and then close the channel. Historically it was not required to include a fee for every transaction. The spender doesn't need to match the inputs and outputs of their transaction exactly to Bitcoin's full 10 nanobitcoin precision, but can instead overpay or underpay fees slightly by including inputs that are respectively slightly more or slightly less than the desired amount. Today, low priority is mostly used as an indicator for spam transactions and almost all miners expect every transaction to include a fee. Instead, Bitcoin users set their own transaction fees manually with each outgoing transaction. This means that miners attempting to maximize fee income can get good results by simply sorting by feerate and including as many transactions as possible in a block:. Not all techniques will apply to all situations, and some techniques require trading off other benefits for lower fees. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Buy Bitcoin Worldwide does not offer legal advice. The amount of fee a transaction pays is proportional to its size in vbytes , and one the main contributors to size is the number of inputs the transaction spends. Copy Link.

Recent posts CoinTracking Review: Bitcoin transaction vary in size for a variety of reasons. This can make them extraordinarily efficient—for example, imagine making a million in-channel payments for the cost of just two transaction fees. This helps communicate the status of all affected payments to the recipient, but it may not be entirely clear what's happening to users who aren't familar with replacements. So, for example, a transaction that has 2 inputs, one of 5 btc with 10 confirmations, and one of 2 btc with 3 confirmations, and has a size of bytes, will have a priority of. You can always how long do deposits to coinbase usd wallet take how many blocks in ethereum chain this by tracking the status of mempool unconfirmed transactions. Bitcoin transaction fees are often significantly cheaper than the fees charged by banks and other services, particularly if you are how do you buy bitcoin cash directly tenx coin international payments. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with keepkey rc sending failed ledger nano s to investing. As of earlyno payment channel implementation is widely used, but several cooperating implementations of a first version of Lightning Network are available. To spend a single collection of funds takes a minimum of 79 vbytes under normal circumstances. Cryptocurrency Terms and FAQ. Transactions needed to have a priority above 57, to avoid the enforced limit as of client version 0. This site keeps a record of how Bitcoin transaction fees evolve over time. Become a Part of CoinSutra Community. Privacy policy About Bitcoin Wiki Disclaimers.

However, the rule that all outputs must be 0. This means that there's a single sequential order to every transaction in the best block chain. For a standard transaction with inputs. So, there are two factors determining transaction fees -- network congestion and transaction size -- and they also play a critical role in the time taken for a transaction to be confirmed. Use wallets that allow you to set custom transaction fees instead of a forcefully recommended fee structure. Seeing as miners bitcoin atms selling cryptocurrencies what crypto currency exchanges exist in canada receive a flat reward of In the example, this means that transaction B is now considered as a combination of transaction B plus transaction A:. Cryptocurrency Terms and FAQ. This windows cpu bitcoin mining windows easy pool mining software the recipients of the first 10 minutes of payments to receive a notification that the payment has been sent up to 20 minutes earlier than with normal batching, and it also gives those early payments a chance to confirm at a lower-than-expected feerate. Technically, finding more blocks is an energy and cost-intensive process which takes time, and thus makes sense bitcoin mining a lot of pc working for nothing giveth ethereum including transactions that pay them more. This bugfix came with a convenient side effect: This section describes the rules of that dependency system, how miners can maximize revenue while managing those dependencies, and how bitcoin spenders can use the dependency system to effectively increase the feerate of unconfirmed transactions. How to invest in Bitcoin. The section below about change avoidance addresses how one of these cases can itself be eliminated as a cost. If none of those things happens, the spender can then increase "bump" the transaction's fee to increase its probability of confirming. Then transactions that pay a fee of at least 0. Even when paying slightly more fees than desired, this can result in savings if the slight increase in fees is still less than would normally be paid for the extra 32 vbytes or so for a change output and the typical mininum of 69 vbytes for later spending that output. As of earlyno fee to transfer bitcoin will bitcoin transaction fees lower channel implementation is widely used, but several cooperating implementations of a first how to find bitcoin address on slushpool extreme coin bitcoin of Lightning Network are available. Although long wide transactions may contain more total fee, the high-feerate tall transactions are the most profitable to mine because their area is greatest compared to the amount of space length they take up in a block.

Buy Bitcoin Worldwide is for educational purposes only. This page was last edited on 30 April , at Navigation menu Personal tools Create account Log in. There's actually a pretty neat solution that offers some minor, but immediate relief. During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed. This is when the average Bitcoin transaction fees will go up. Each block in the block chain also has a sequential order, one block after another. This page provides a list of currently-available techniques that may allow spenders to reduce the amount of transaction fee they pay. To calculate the fees per transaction, we consider that the average Bitcoin transaction is about bytes big. For high-frequency spenders, this effect can be large and can provide significant additional second order savings. However, once native segwit adoption increases just slightly, this is not expected to adversely affect privacy. The difference between the amount being spent and the amount being received is the transaction fee which must be zero or more. What are the transaction fees? Sister projects Essays Source. Each input adds a minimum of 41 vbytes to the transaction and almost always 69 or more vbytes, so any strategy that reduces the number of inputs is worth considering. Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. This helps communicate the status of all affected payments to the recipient, but it may not be entirely clear what's happening to users who aren't familar with replacements.

The amount of fee a transaction pays is proportional to how to mine scrypt in terminal how to mine sigt size in vbytesand one the main contributors to size is the number of inputs the transaction spends. A quick refresher on Bitcoin mining: We'll deal with this complication in a moment. If all wallets adopted it, this would effectively lead to a small increase in the available block space:. So, if the mempool is full, users looking to get their transactions through will compete on fees. These miners spend a lot of computing power and energy when verifying a block of transactions from the Bitcoin Mempool short for memory poolwhich contains unconfirmed transactions waiting to be added to a block for confirmation. Miner fees are a fee that spenders may include in any Bitcoin on-chain transaction. Instead, Bitcoin users set their own transaction fees manually with each outgoing transaction. Privacy policy About Bitcoin Wiki Disclaimers. This page was last edited on 17 February turn bitcoin into cash ledger wallet vs trezor, at This can be attributed to the smaller Bitcoin Mempool size. We can easily visualize that by drawing four transactions side-by-side based on their size length with each of our examples larger than the previous one:. Retrieved from " https:

However, Bitcoin transaction fees, unlike the transaction fees charged by banks and other payment providers, do not have a set percentage rate e. May 2, Jump to: However, once native segwit adoption increases just slightly, this is not expected to adversely affect privacy. This allows the recipients of the first 10 minutes of payments to receive a notification that the payment has been sent up to 20 minutes earlier than with normal batching, and it also gives those early payments a chance to confirm at a lower-than-expected feerate. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Not surprisingly, Bitcoin has become extremely popular as a way to send money digitally across the globe as it solves critical problems faced by transactions executed in fiat currencies. What is the most asked question in the Bitcoin community? The fees shown at the historic charts and tables are in US dollars per transaction and in satoshis per byte. Legacy SegWit. At the time of writing this article, according to bitcoinfees. The amount of savings varies depending on the details of your transaction, but here are a few common transaction types an an example:. This section describes why feerates are important and how to calculate a transaction's feerate. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. You guessed it right — what is an ideal Bitcoin transaction fees? Bitcoin transaction fees are a fundamental part of the Bitcoin network , but they can be a little confusing for newcomers to the space. However, if a user is willing to pay a higher transaction fee, then the first confirmation could arrive in 10 minutes, which is the time taken to mine a block.

Legacy SegWit. In command-line and RPC wallets, there's often a call such as sendmany that lets you pay multiple recipients. Today miners choose which transactions to mine only based on fee-rate. This section currently focuses on enforceable offchain payments, but it may later be expanded to cover concepts for unenforcable offchain payments that use cryptography and other security solutions to provide more secure and more private solutions than simple trusted third parties. But if transaction A and B both appear in the same block, the rule still applies: Facebook Messenger. Already widely deployed but still being improved as research and development continues. The transaction fee you pay will only affect the time you have to wait until the first confirmation. Content is available under Creative Commons Attribution 3. Very useful for high-frequency spenders e. Useful for high-frequency recipients e. Buy Bitcoin Worldwide is for educational purposes. This allows the recipients of the first 10 minutes of payments to receive a notification that the payment has been sent up to 20 minutes earlier than with normal batching, and it also gives those early payments a chance to confirm uninstall ethereum wallet buy stuff with bitcoin bay area a lower-than-expected feerate.

Other wallets may not show transactions opting in to replacement at all until one version of the transaction has been confirmed. For high-frequency spenders, this effect can be large and can provide significant additional second order savings. The fees shown at the historic charts and tables are in US dollars per transaction and in satoshis per byte. The initial transaction version could be broadcast immediately, and each of the replacements would pay successively higher fees. When a miner creates a block proposal , the miner is entitled to specify where all the fees paid by the transactions in that block proposal should be sent. You can read about it here more. Not every Bitcoin payment needs to be added to the Bitcoin block chain. Once a wallet supports native segwit, it can begin using it immediately for any change outputs it generates back to itself without waiting for anyone else to begin using native segwit. Now comes the million dollar question: The following examples and savings are compared to the size of the P2SH-wrapped examples above:. Authored By Sudhir Khatwani. You can learn more about Satoshis and its calculation from our blog post: Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. Universally useful.

During periods of higher effective maximum block sizes, this natural and unpredictable variability means that transactions with lower fees have a higher than normal chance of getting confirmed—and during periods of lower effective maximum block sizes, low-fee transactions have a lower than normal chance of getting confirmed. Become a Part of CoinSutra Community. Retrieved from " https: In graphical wallets, there's often a button that allows you add additional recipients to a transaction see image below. Currently, transaction replacement does have one significant downside: Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. Privacy policy About Bitcoin Wiki Disclaimers. So, there are two factors determining transaction fees -- network congestion and transaction size -- and they also play a critical role in the time taken for a transaction to be confirmed. In addition, also as of early , some techniques have recently been described that could significantly improve fee estimation, such as factoring current mempool data into confirmation-based fee estimates. In addition, demand varies according to certain patterns, with perhaps the most recognizable being the weekly cycle where fees increase during weekdays and decrease on the weekend:. In this case, we can't, so no changes are made.

Fr

Fr 中文

中文