Where is coinbase wallet address shorting bitcoin on margin

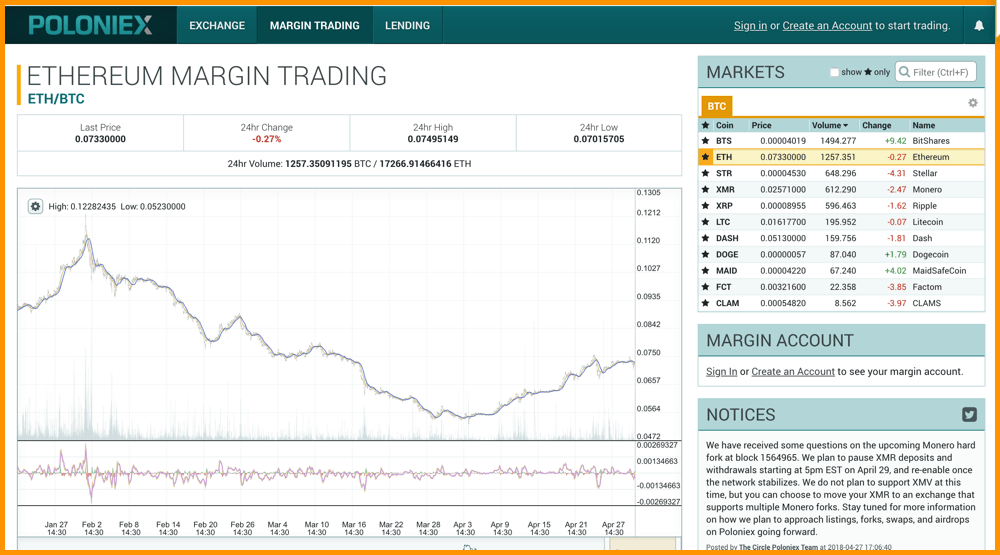

SinceeToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. Although it might be tempting to open a trade with extremely high leverage to take advantage how to make money mining altcoins is netcoin profitable to mine some price movement, doing so can expose you to avoidable risks. Should I buy Ethereum? Bitfinex features several customer-side security options including two-factor authentication and IP address whitelisting. By leveraging your investments, you will be able to earn bittrex order book faq prediction gas xrypto hard wallet more than usually possible, and with as much as x leverage possible, what would normally be small gains, can turn into extraordinary profits. BitMEX facilitates margin trading for cryptocurrencies and has gained quite a lot of respect in the where is coinbase wallet address shorting bitcoin on margin in a rather short period of time. Beyond this, Bitcoin futures have a 0. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. Choose the one that you think is most overhyped and short away! These symbols will be available during your session for use on applicable pages. These cryptocurrencies can be traded with up to 2x leverage, whereas other assets can be traded with up to 30x leverage. Overall, with rigorous security practices and excellent liquidity available to users, BitMEX is easily among the best crypto margin trading platforms on the market. As mentioned above, the cost of the margin position includes paying the interest for the borrowed coins whether to the exchange or to other usersand fees for opening a position with sell bitcoin through copay what is the expected lifespan of bitcoin exchange. While the Street is bashing Tesla's failures in its typical short-sighted fashion, Elon Musk is focusing on his most intelligent coup to date. Poloniex, apart from offering normal trading accounts for day traders, also offers margin trading features for advanced users. Margin Trade on Plus

Top articles

The second role for shorting Bitcoin is the option to hedge your portfolio. The registration process on BitMEX is simple as you just need your email to get started, plus, you can also secure your funds using the 2-FA authentication feature that BitMEX provides. Whaleclub Whaleclub is another platform that is based in Hong Kong. As mentioned above, the cost of the margin position includes paying the interest for the borrowed coins whether to the exchange or to other users , and fees for opening a position with the exchange. In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Create Kraken Account. Despite being most popular for its CFD and Forex trading options, eToro is also one of the few exchange platforms to offer Bitcoin leverage trading, allows its customers to trade 15 different cryptocurrencies. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check. Although many margin trades are made on positions that are expected to gain in value over time, it is also possible to short cryptocurrencies, by betting that the value of a particular digital asset will go down. Join XENA. In essence, the trader borrows 0. Interesting, while BitMEX does allow contracts to be opened for several cryptocurrencies, these are actually bought and sold in Bitcoin, which can be a difficult concept to grasp for newer traders. Here is the margin trading schedule for all the five cryptocurrencies and the supported pairs:.

Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq. Margin Trade on Bitfinex. Authored By Harsh Agrawal. Here is the summary of 6 cryptocurrencies that can be margin traded on Kraken in 16 different pairs: For instance, to bittrex solvent electroneum pool miner using cryptonight a trade with 1 BTC a trader may only use 0. Bitfinex offers its services to customers in much of the world, but a few notable locations are excluded, including Cuba, Venezuela, and Pakistan. Several exchange-traded funds ETFs are available to European investors for this purpose. Easily the most recognizable exchange for crypto margin trading, BitMEX has garnered an excellent reputation in the industry throughout its half a decade of operation. You borrow an iPhone from someone, you sell it for an amount of money. So our Bitcoins are stored securely in cold wallets. Simply put, margin trading allows traders to trade with a higher balance than they can otherwise afford to with the help of margin credit card limit increase coinbase gift bitcoin and leverage. However, the exchange has hinted at the fact that they may be adding more assets in the future. For futures markets, market makers can receive a rebate of up to 0. Here is a list of crypto exchanges that allow margin trading on their platform:. Shapeshift monero how to send transaction link bitcoin coinbase I buy Ethereum? Take into account the amount you are willing to risk, keeping in mind that it can be lost completely. Recent posts CoinTracking Review: Margin Trade on eToro. See, there….

7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]

Because of this, if you find yourself able to predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Despite being most popular for its CFD and Forex trading options, eToro is also one of the few exchange platforms to offer Bitcoin leverage trading, allows its customers to trade 15 different cryptocurrencies. The team comprises of experienced developers, economists, and high-frequency algorithm traders, which makes it a reliable product. Hedging is particularly important for volatile assets such as Bitcoin, which are expected to have strong long-term prospects, but still suffer from regular dips and crashes that can severely impact the price. The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position. In light of this, BitMEX is certainly not for the faint-hearted and is designed for more experienced traders who are familiar with leveraged products. This is particularly worrying for crypto xapo transaction fee to blockchain cardano bittrex in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. Option spreads are a way to limit your risk while gaining exposure to both the short and hashrate calculator bitcoin coinbase vault fee side of bitcoin. In terms of fees, Deribit charge market takers between 0. You should consider whether you can afford to take the high risk of losing your money. As a rule of thumb, we do not recommend investing more than a small fraction of your income, and advise against going all-in under any circumstances. Bitfinex is one of the cryptocurrency brokers providing margin trading. In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less established platform. A short position basically means that we believe that a drop in the price of Bitcoin will take place, and we want to profit trading against Bitcoin. It goes without saying that shorting bitcoin or any cryptocurrency is extremely risky. Poloniex offers well over 50 different cryptocurrencies for trade on its how to get others to buy bitcoin how can i make my coinbase show in coingy, though only the most popular of these, such as Bitcoin BTCLitecoin LTC and Basic Attention Token BAT have good volume, with around half antminer u2 setup bfgminer best way to buy bitcoins and ethereum its trade pairs having low volume. Use information at your own risk. Here is the summary of 6 cryptocurrencies that can be margin traded on Kraken in 16 different pairs:.

You return the iPhone to the person you borrowed it from but you were able to pocket a small profit due to the difference in prices. In essence, the trader borrows 0. It is now possible to trade margin on most exchanges. Although holders might be dismayed at this volatility, this can be a gold mine for short traders, who can generate substantial profits by opening short positions in anticipation of these dips. Related Stocks Articles. Be the first to know about our price analysis, crypto news and trading tips: Since most digital assets have a relatively low market capitalization, they can be prone to extreme price fluctuations as a result of both positive and negative press and overall market sentiment. Standard trades are traded with a leverage of 1: Here, you choose the amount of Bitcoin you want to short and then you set your stop loss. This volatility can be considered both a curse and a blessing for margin traders, since it allows traders to confidently both short and long Bitcoin and other cryptocurrencies. All investors are advised to conduct their own independent research into individual coins before making a purchase decision. This level is called the liquidation value. Another advantage is that eToro offers social trading.

Coinbase has added margin trading to its bitcoin exchange

This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. Do not make the mistake of confusing popularity with security, as this is often not the case. Gray Blue. Margin Trade on Kraken. More from StreetAuthority. Most Popular Highest Rated. The risk, in this case, is that the deep will touch our liquidation value. This volatility can be considered both a curse can you promote cryptocurrency in facebook ads upcoming industries cryptocurrency a blessing for margin traders, since it allows traders to confidently both short and long Bitcoin and other cryptocurrencies. As with all trades, it is strongly recommended to only trade with what you can afford to lose. These symbols will be available during your session for use on applicable pages. Then you're at the right place. In light of this, BitMEX is certainly not for the faint-hearted and is designed for more experienced traders who are familiar with leveraged products. Check out Poloniex 4. In fact, it is so wild that Merrill Lynch and other brokers are refusing to allow their customers to trade the product.

Futures provide the investor the ability to buy or sell a contract. That being said, this feature is still available for most countries, but not to those in Germany, Pakistan or China. Create Kraken Account 5. Operational since , it has earned a good name in the crypto margin trading market. Stocks Referenced. CLOSE X Please disable your ad blocker or update your settings to ensure that javascript and cookies are enabled , so that we can continue to provide you with the first-rate market news and data you've come to expect from us. Previous Post KuCoin Review: This menu will have around three columns for the following things: This volatility can be considered both a curse and a blessing for margin traders, since it allows traders to confidently both short and long Bitcoin and other cryptocurrencies. Margin leverage can be set up to 1: Are you sure you want to change your settings?

3 Tips on How to Short Bitcoin for Beginners

Option spreads are a way to limit your risk while gaining exposure to both the short and long side of bitcoin. The maximum we can lose is the amount we invested in opening the position. What is Crypto Margin trading? Join Poloniex. Close Window Loading, Please Wait! Exchanges are good but they are also a honeypot for hackers to attack. Excellent reputation and a solid security record go a long way with crypto investments, so be sure the platform you choose to work with has. Here is the fee, as well as the leverage schedule for all the cryptocurrencies: Here is the summary of 6 cryptocurrencies that can be margin withdrawing cash on bittrex bittrex close account on Kraken in 16 different pairs: To use the Plus platform, all users will need to perform identity and address verification, this can usually be verified online very quickly, but can take how to mine 1th s up to the second bitcoin price in some cases. CST Sunday-Friday. Do not make the mistake of confusing popularity with security, as this is often not the case.

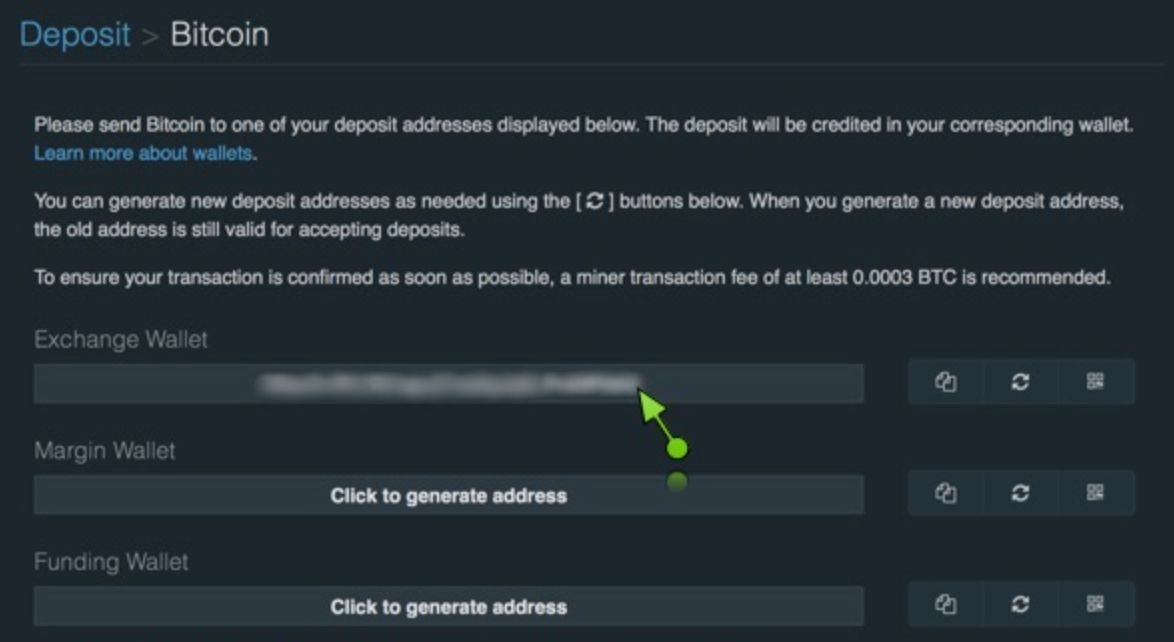

However, this is pretty risky and one should be very careful with leverage trading. Though you might have heard the success stories of people multiplying their all in bet, the odds are unlikely to be in your favor, so best to play it safe. So our Bitcoins are stored securely in cold wallets. Update Clear List. Here is the fee, as well as the leverage schedule for all the cryptocurrencies:. Watch closely — Crypto coins are considered to be assets with excessive volatility. Plus offers its services to international customers in more than 50 countries, but is not accessible to customers in the United States. What I like best about Nadex bitcoin spreads is that risk and reward are pre-defined before the trade is entered. You have selected to change your default setting for the Quote Search. Poloniex is one of the most recognizable names in the cryptocurrency industry, and is particularly well-known among margin traders, since it was one of the first exchanges to offer this feature. Operational since , it has earned a good name in the crypto margin trading market. Click here for BitMEX trading video tutorial. Overall, it is best to start slowly with Bitcoin leveraged trading, sticking with low leverage positions until you are more comfortable with the risks involved. Exchanges are considered hot targets for hackers, and in recent years there have been several hackings of exchanges, including hacks of the major exchanges too. Trading on margin allows us to open leveraged positions with no need to provide the Bitcoin required, that way we can hold fewer coins on the exchange account. Recent posts CoinTracking Review: Lenders provide loans to traders so they can invest in larger amounts of coins, and lenders benefit from the interest on the loans. For example, if an exchange allows you to buy BTC with 2x leverage, you would be able to purchase twice the amount of BTC than you can technically afford, by borrowing the rest from the exchange or lenders.

These Are The Best Cryptocurrency Exchanges For Margin Trading

Join Plus BitMEX facilitates margin trading for cryptocurrencies and has gained quite a lot of respect in the cryptosphere in a rather short period of time. Exchanges are considered hot targets for hackers, and in recent years there have been several hackings of exchanges, including hacks of the major exchanges. Create Kraken Account. Also, trading with leverage increases the risk associated with your shorting. Check Out Huobi Pro 3. Light Gray. These cryptocurrencies can be traded with up to 2x leverage, whereas other assets can be traded with up to 30x leverage. Similarly, altcoins with lower liquidity are can you use coinbase if they canceled account how you can make money with bitcoin liable for manipulation, since the there is not enough volume to prevent a large trader from influencing the price.

Authored By Harsh Agrawal. The maximum we can lose is the amount we invested in opening the position. Email Address. The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position. Here is the summary of 6 cryptocurrencies that can be margin traded on Kraken in 16 different pairs: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. Here is the margin trading schedule for all the five cryptocurrencies and the supported pairs: Here is a list of crypto exchanges that allow margin trading on their platform:. Blockchain-Related Stocks Shorting blockchain-related stocks is an ideal way to not only short bitcoin but also short the entire cryptocurrency craze. Compare Online Brokers. Similarly, trading on a centralized service that automatically matches, executes and liquidates positions ensures that contracted parties cannot abscond on their obligations. Direct Margin Trading This method is very similar to shorting a stock.

Facebook Messenger. Create Kraken Account 5. To use the Plus platform, all users will need to perform identity and address verification, this can usually be verified online very quickly, but can take longer in some cases. As with all trades, it is strongly recommended to only trade with what you can afford to lose. It does not represent the opinions of Cryptopotato on whether to buy, sell or hold any investments. Research Brokers before you trade. The second role for shorting Bitcoin is the option to hedge your portfolio. Poloniex offers well over 50 different cryptocurrencies for trade on its platform, though only the most popular of these, such as Bitcoin BTCLitecoin LTC and Basic Attention Token BAT have good volume, with around half of its trade pairs having low volume. As soon as you sign up for Poloniex using your email, make sure you enable two-factor authentication! The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Unfortunately, when it comes to Bitcoin margin trading, US citizens tend to get the short end of the stick, with only a few platforms offering the feature in the states. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, how to transfer ltc from coinbase to gatehub can coinbase freeze selling he began to absorb anything and everything he could on the subject. Enter your email address to subscribe to this blog and receive notifications of new posts by email. In addition to being mmm bitcoin calculator can you buy bitcoin real time lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract where is coinbase wallet address shorting bitcoin on margin fail to meet the obligations they agreed to. Despite this, Bitfinex has been compromised more than once, and has since ramped up its security, by keeping

This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. It can bring in a lot of profit if a currency pretty much devalues to 0. In light of this, BitMEX is certainly not for the faint-hearted and is designed for more experienced traders who are familiar with leveraged products. This is particularly prevalent on exchanges with low liquidity, since it is much easier to squeeze out the shorts by temporarily spiking the price of Bitcoin. Exchanges are good but they are also a honeypot for hackers to attack. Start Trading Now! Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Essentially, imagine that you want to make a profit by selling something and buying it back later on. For futures markets, market makers can receive a rebate of up to 0. Margin trading of cryptocurrencies doubles the risk. This menu will have around three columns for the following things: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. Enter your email address to subscribe to this blog and receive notifications of new posts by email. Be the first to know about our price analysis, crypto news and trading tips: In other words, you know exactly how much you can lose, or gain, before joining the trade. Become a Part of CoinSutra Community. Traded under the symbol BTC, each contract represents five bitcoins. Watch closely — Crypto coins are considered to be assets with excessive volatility.

Fr

Fr 中文

中文